Private equity giant Vista Equity Partners has announced plans to take Duck Creek Technologies private in a $2.6 billion deal.

Boston-based Duck Creek, a SaaS-based software provider for the property and casualty (P&C) insurance sector, went public back in 2020, initially hitting a market cap of around $5 billion. After peaking at around $7 billion in early 2021, Duck Creek’s fortunes have fallen somewhat, with its valuation plummeting to below $2 billion over the past year, with a closing price of around $13 per share as of Friday.

Vista’s $19 per-share offer represents a 46% premium on Duck Creek’s most recent market closing price, and a 64% premium on its volume-weighted average price (VWAP) over the previous 30 days, equating to $2.6 billion, which Vista said it will pay in an all-cash transaction.

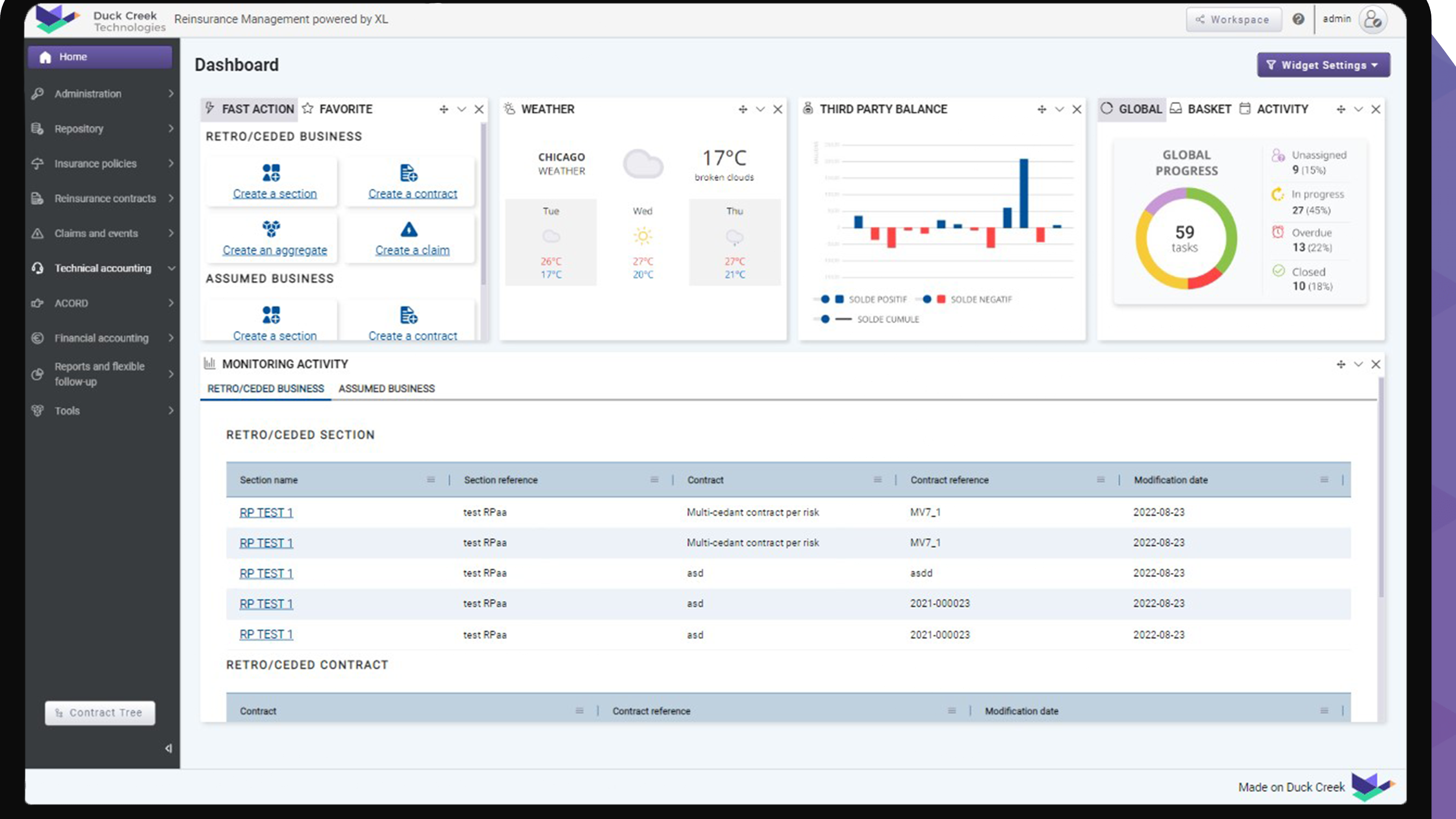

Duck Creek

Enterprising

It’s worth noting that Vista has been at the center of some of the biggest enterprise deals over the past year, including Citrix, which Vista partnered with Evergreen/Elliott on to acquire for $16.5 billion. Vista also snapped up automated tax compliance company Avalara for $8.4 billion, while it sold disaster recovery company Datto for $6.2 billion.

Specific to today’s announcement, Vista also has some history in the insurance software space, having acquired the likes of Applied Systems, Eagleview and Vertafore over the past couple of decades.

“Vista has an established track record of partnering with leading enterprise software businesses within the insurance industry and related verticals,” Vista managing director Jeff Wilson said in a press release. “We are excited to work with the Duck Creek team as we look to build on their best-in-class platform and solutions, which serve many of the world’s leading P&C insurance carriers.”

Vista said that it expects to conclude the transaction in Q2 2023.

Vista Equity Partners to acquire insurance software company Duck Creek for $2.6B by Paul Sawers originally published on TechCrunch

DUOS