Will Ross and William Steenbergen were AI researchers at Stanford working on climate and atmospheric modeling and reinforcement learning, respectively, when they began to collaborate on wildfire modeling and hurricane modeling initiatives for the insurance industry. They were surprised to learn how big of a difference there was between what the data told insurers to do and what carriers were actually doing, according to Ross. After studying the problem, Steenbergen and Ross launched Federato to provide insurers a unified view of information to select and price risks.

Now, Federato is raising new capital to grow the business. Emergence Capital led a $15 million Series A round in the company, which recently closed with participation from investors, including Caffeinated Capital and Pear. A portion of the cash will go toward expanding headcount, Ross told TechCrunch via email, from Federato’s current 23 employees to 50 by the end of the year.

The way Ross sees it, the insurance industry faces three major challenges today: climate-related increases in natural disasters; “loss uncertainty” in insurance risks, including state-sponsored cyberattacks and ransomware; and payout inflation caused by verdicts against insurers in a litigious environment. He pointed to Russia sponsoring cyberattacks on U.S. businesses, which might or might not be covered under the “war exclusion” clauses typical in cyber policies, and recent rulings related to the opioid crisis, accidents involving commercial trucks and asbestos that raise questions about whether corporations should be allowed to transfer risks.

“Many insurers come to Federato looking for a tool to help create operational efficiencies, something the unified underwriting workflow element of the platform does very well,” Ross said. “The reality is, they end up buying because they come to understand the value of the reinforcement learning driven approach to portfolio management, which provides invaluable insights for managing portfolio risk, balancing and growing their book of business.”

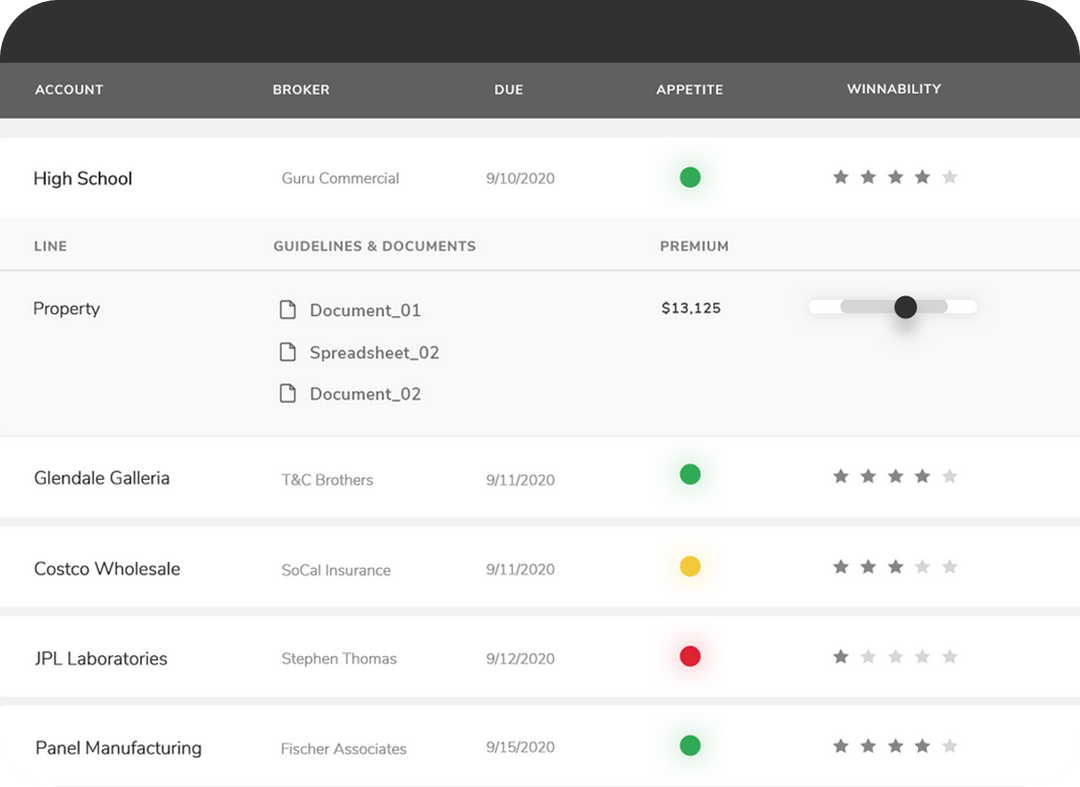

Using the platform, customers — primarily insurers — can visually monitor risk and manage their policy portfolios, leveraging workflows aimed at minimizing the need for manual tasks like hunting for risk data and coming up with underwriting guidance.

Image Credits: Federato

Federato also claims to use machine learning, creating a common framework for portfolio management while ensuring it’s optimized to each organization’s constraints. The platform uses a “mathematical representation” of underwriting strategies to identify trends, Ross says, fine-tuning from there as necessary.

“[T]he beauty of Federato’s approach is that all of its customer contracts are quite clear that it does not share or pool customers’ proprietary information,” Ross explained. “[Any] meta-learning that occurs based on very-high-level usage data still allows for some level of moat to be developed, but customers know that their customer data and loss experience is not being shared.”

Ross positions Federato as an alternative to in-house services providers like Accenture and EY, as well as legacy vendors such as FirstBest and Pegasystems. He declined to disclose how many customers the startup currently has, but he identified several by name, including Insurate, QBE North America and Propeller Bonds.

Ross says that Federato will likely break even in terms of cash flow in the second half of this year.

“The property and casualty insurance industry is in a uniquely countercyclical moment as inflation and high interest rates mean that property and casualty stocks are actually up over the last six months, while other industries are suffering,” Ross aid. “That dynamic, combined with a greater emphasis on talent (the Great Resignation) and digital tools and workflows due to the pandemic (the move to remote work), has actually accelerated Federato’s growth … Prior to the pandemic, insurance was heavily reliant on manual processes — and it still is.”

Federato raises $15M to help insurance customers manage risk by Kyle Wiggers originally published on TechCrunch

DUOS