The Finance Ministry says it is poised to lessen the impact of the intended financial restructuring on the stakeholders in the country.

According to the Director of the Ministry’s Financial Sector Division, the plight of affected parties will be prioritised as government engages with the International Monetary Fund (IMF) on the approach to the debt readjustment.

Samson Akligoh assured that “no decision will be taken without external conversations… It is important that nothing is done to compromise the banking system and destroy people’s confidence in the banking sector as a whole.”

He, however, fell short of highlighting whether the government is likely to settle for a domestic or external debt restructuring modality.

This comes on the back of concerns raised by experts on the propensity of a purely domestic restructuring modality to do very little in rescuing the economic downturn.

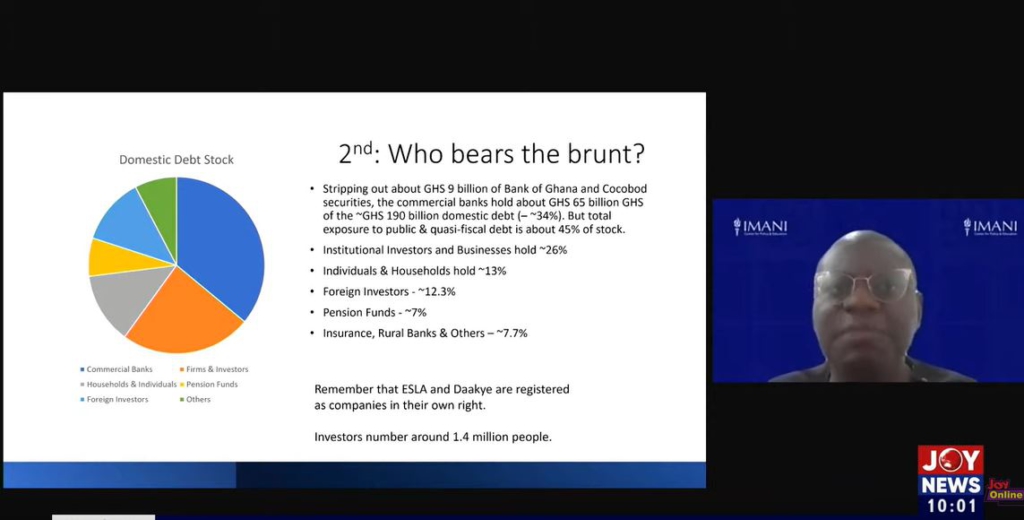

Institutional investors, financial institutions, and pension funds rank amongst the hardest hit by the intended debt restructure.

As Ghana wallows in an ailing economy, experts are banking their hopes on external economic restructuring measures to help salvage the situation.

But speaking on Newsfile, Samson Akligoh explained that the Finance Ministry has all the financial sector players at the core of its IMF talks and will be industry-led.

“I understand why the analysis will say this… But if you’re within the Ministry of Finance the job is that you have to do whatever you can to minimise the impact so that the economy is not disrupted.”

He also admitted that “yes, we have a difficulty. But it is not something that we cannot sail through.”