The moment has finally come. Today, Netflix hosted a press call to reveal a preview of its new ad-supported tier, “Basic with Ads,” which will launch on November 3 in the U.S. and cost $6.99 per month, $13 less than Netflix’s Premium plan. This aligns with reports that the new plan would be $7-$9.

Plus, Nielsen will be Netflix’s audience measurement partner, a surprising twist since Nielsen has been criticized for reporting inaccurate streaming data.

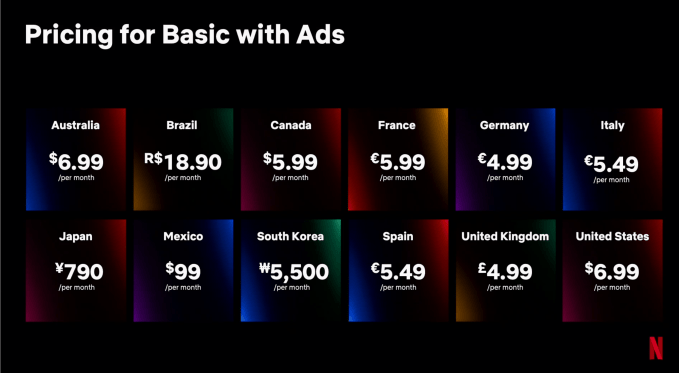

The cheaper tier will roll out across 12 markets to start. On November 1, Canada and Mexico subscribers are the first to try the new plan. It will then roll out to the U.S., the UK, France, Germany, Italy, Australia, Japan, Korea, and Brazil on November 3. Spain will be the last to see the tier, launching on November 10.

The launch dates confirm reports that the ad tier would roll out in 2022, contrary to Netflix’s previous announcement that it would launch in early 2023. The streaming giant will beat rival Disney+ by one month, which is launching its ad-supported plan at $7.99 per month on December 8, in tandem with a price hike of its ad-free plan.

Not only will Netflix have a slightly cheaper tier than Disney+–every dollar counts–but all of Netflix’s ad-free plans will remain the same price as well.

In today’s announcement, Netflix wrote, “While it’s still very early days, we’re pleased with the interest from both consumers and the advertising community — and couldn’t be more excited about what’s ahead. As we learn from and improve the experience, we expect to launch in more countries over time.”

There are some downsides, though. While subscribers can enjoy various Netflix titles at a lower price while also streaming on multiple simultaneous devices, the company has still not worked out the rights to various shows and movies.

“A limited number of movies and TV shows won’t be available due to licensing restrictions, which we’re working on,” the company added.

During the call to press, Greg Peters, Chief Operating Officer, Netflix, said that the percentage of unavailable titles varies from country to country. At launch, approximately 5 to 10% of Netflix’s catalog will be missing from the ad-supported plan. “We’ll work to reduce that number over time,” Peters said.

Netflix previously told investors that it was renegotiating deals with media companies.

Also, Netflix confirmed earlier reports that offline viewing would be unavailable, which is standard for many AVOD (ad-supported video-on-demand) services.

Like the Netflix basic plan, the ad-supported tier will have a video resolution of 720p HD, whereas the standard and premium plans have 1080p HD video. Subscribers of the basic tiers also don’t get 4K viewing, which is only available for premium viewers.

Each ad will only be 15 or 30 seconds long which will play before and during shows and movies. On the bright side, new Netflix movies on the service will get pre-roll ads and not have interruptions. However, older movies will get mid-roll ads as well as pre-roll.

There will be a limited ad load to an average of 4-5 minutes of ads per hour, which is Disney+’s plan as well.

Netflix agrees to work with Nielsen

Marketers will likely be happy that the streamer will have partners other than Microsoft.

Nielsen will use its Digital Ad Ratings in the United States and eventually report Netflix ratings through Nielsen ONE Ads. The reporting will begin “sometime in 2023,” Netflix wrote.

Nielsen has measured TV audiences on Netflix since 2017, however, has been accused of reporting numbers that are different than Netflix’s own reporting.

Netflix also partnered with DoubleVerify and Integral Ad Science to “verify the viewability and traffic validity” of the advertisements, the company added.

Yesterday, Netflix signed up with British TV ratings agency Broadcasters Audience Research Board to measure Netflix’s streaming numbers in the UK—a surprising move for a streaming service that is notoriously close-mouthed about its viewership data.

Netflix hopes it can earn revenue through advertisements after a rough quarter in July, with the painful loss of 970,000 subscribers.

Earlier this week, JP Morgan analyst Doug Anmuth estimated that, in 2023, Netflix could gain 7.5 million subs to its ad-supported tier in U.S. and Canada, which could drive $600 million in advertising sales. By 2026, Anmuth predicted the streamer would increase by 22 million subscribers in the region, along with $2.65 billion in advertising sales.

The streamer has also tried other strategies to generate revenue, like several rounds of layoffs and a paid sharing offering set to roll out to all markets next year.

While Netflix probably doesn’t want the majority of its 220 million subscribers to downgrade to its ad-supported plan, many consumers will likely opt for the cheaper tier. Comcast found that 80% of viewers would rather subscribe to an ad-supported service over a pricer ad-free service.

Technology research group Omdia suggests that almost 60% of global Netflix subscribers will choose the ad-supported tier. If a bulk of current subscribers downgrade to the cheaper tier, the streamer could experience a decrease in subscription revenue.

Peters claimed, “We’re not trying to steer people to one plan or the other we really want to take a pro-consumer approach and let them land on the right plan for them. And we think that the revenue model will be fine as a result.”

The announcement comes on the heels of Netflix’s Q3 earnings results, which will be announced next week on Tuesday, October 18.

Netflix undercuts Disney+ with launch of its $7/month ad-supported plan starting Nov. 3 by Lauren Forristal originally published on TechCrunch

DUOS