Welcome to Startups Weekly, a fresh human-first take on this week’s startup news and trends. To get this in your inbox, subscribe here.

YC had its biggest news in years this week: Garry Tan will be the new president and CEO of the organization, starting January 2023. Tan co-founded and helped scale Initialized Capital to a venture firm that now manages over $3.2 billion in assets. All the while, he’s always had roots in YC, both as a former partner at the organization.

One detail that didn’t make my story this week is how Tan is bringing a content creator vibe back to @ycombinator’s leadership ranks. He’s succeeding Geoff Ralston, who wasn’t too public about his work at the accelerator. Tan, however, has amassed over 220,000 YouTube subscribers for his tech videos. Topics on Tan’s youtube channel range from how to lead like a champion to how dev teams can build like Google, and, yes, how to apply to YC in 2022. It’s reminiscent of YC co-founder Paul Graham’s essays, many of which inspired entrepreneurs to jump into startups to begin with.

YC’s choice to put a creator at the helm is in line with their product focus over the past year. In June, the accelerator announced Launch YC, a platform where people can sort accelerator startups by industry, batch and launch date to discover new products. Launch YC invites users to vote for newly launched startups “to help them climb up the leaderboard, try out product demos and learn about the founding team.”

As standing out inside of YC has become more difficult, and given how important distribution is for early-stage startups, YC offering a way for startups to make a bit more noise might make the implied equity cost of its program more attractive. Tan continues that same focus, both as a well-known personality within tech and a creator who has spent years building up a brand focused on early-stage startups.

Creator news aside, the Y Combinator executive shuffle brings up another question: competition. Tan didn’t say how his new role at Y Combinator and his future role at Initialized, which is venture adviser, will overlap when asked about competitive or complementary dynamics. He offered Strictly VC a similar sentiment:

When I left YC, I was always careful to never ask YC partners “Who was hot?” Initialized did their own work. That doesn’t change with me on the inside. Initialized was built to be the ideal firm founders would choose because of the ethos, approach to founders (soft advisership, not your boss) and what makes it extra unique is the large emphasis on team and services from that team. Few firms focused on pre-product-market fit seed do this. The very best ones do, and Initialized is one of them … The community has an investor database that helps them choose, and Initialized is top ranked there and will be as long as it continues to do no harm and help. That doesn’t change either.

These are just the first questions around creators and competition that we have for Y Combinator’s future. Good thing Demo Day, happening next week, is going to continue the conversation.

For my full interview with Tan, check out my TechCrunch story: “Garry Tan’s return is a full circle moment for Y Combinator.” And, to thank you for being a Startups Weekly subscriber, here’s a little TC+ discount for you: Enter “STARTUPS” at check-out for 15% off of your subscription.

In the rest of this newsletter, we’ll get into one app’s surprising closure, the latest and greatest on party rounds and a follow up on a data-driven fund. As always, you can support me by forwarding this newsletter to a friend or following me on Twitter. Appreciate your support, as always!

The ending of Zenly

Earlier this week, Snap laid off 20% of its global staff in an attempt to restructure its business. The cut comes after CEO Evan Spiegel’s May memo, in which he wrote that the company would miss revenue goals in the second quarter.

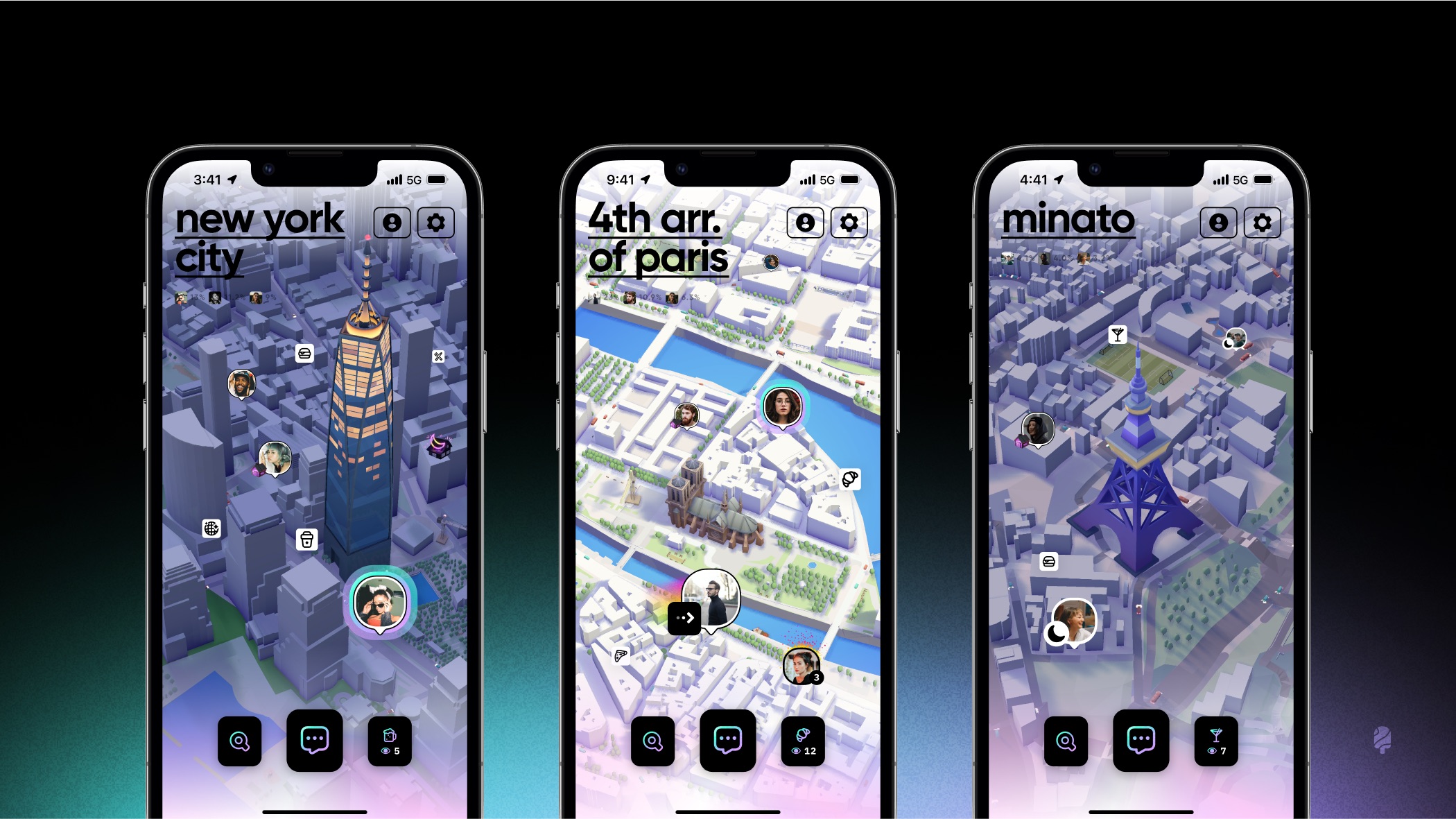

And layoffs aren’t the end of the story. Snap is slowing the production of Snap-funded originals, minis and games, hardware, the Pixy Drone, as well as standalone apps that include Voisey and Zenly. Beyond the fact that Snap says it is still developing its augmented reality glasses, called Spectacles, the surprising tidbit in that refocus is the shutdown of Zenly, a hugely popular app that was acquired five years ago.

It’s common for companies to shutter apps, especially acquisitions, years into the works during restructuring efforts. Plus, Zenly doesn’t generate a ton of direct revenue and still works as a standalone app. Still, as my colleagues Paul Sawers and Romain Dillet point out, there was quite a bit of shock when Snap snuck in the shutdown.

Here’s why it’s important: Sawers and Dillet point out that “Zenly was showing no signs of stagnating, and if anything, it looked like it had the potential to be one of Snap’s prized possessions if it could only figure out how to turn it into a money-making machine.” As you’ll see in their story, it turns out that the shutdown may be Snap playing defense, not just offense.

- Facebook is shutting down its Nextdoor clone next month, following tests in the US and Canada

- Clearco cuts international staff as it retracts presence, announces new partner

- Following its Series A, Poparazzi’s team is readying a new social app that goes beyond photos

- Six conversations that bring nuance to tech’s layoff wave

- The Station: Porsche IPO demand accelerates and more micromobility layoffs

Image Credits: Zenly

Let’s talk about party rounds

I dug into a debate as old as time this week on Equity Wednesday and TechCrunch+: party rounds! The positives are obvious: With more investors on their cap table, startups have more avenues for distribution, introductions and advice throughout their lifecycle.

The cons are more complicated. Is the party-round investment as helpful as capital from fewer, more commitment sources? Are there too many cooks in the kitchen? Is it a negative signal that this startup had to raise from dozens of people instead of one high-conviction partner?

In my story, I interviewed three people from all different seats at the venture table, from the engineer leading products to unbundle these processes, to the party round startup that raised a party round, to an investor whose job it is to collaborate with (and sometimes compete with) the flurry of angels interested in these rounds.

Here’s what’s important: I love when debates actually make a difference, and in this case, they do. It seems like the definition of a party round has changed over the years, partially in response to many of the dynamics that appear when there’s no specific lead investor in a financing round.

- Party rounds are either the dinner party of your dreams or the one where no one shows up

- Coming out of COVID, investors lose their taste for board meetings

- Cantos launches its third fund, ploughing $50M into near-frontier startups

- Fintech startup Alloy leans on fraud prevention to land new $1.55B valuation

- If you missed last week’s newsletter, read it here: “When the party has confetti but no allergen-friendly appetizers.”

Image Credits: dehooks

The follow-up

I’m experimenting with a new section in Startups Weekly, where each week we follow up with an old story or trend to see what’s changed since our first look. This week, I checked in with Abe Othman, the brains behind data science at AngelList Venture — including its $25 million Quant Fund. In December 2021, I broke the news of the startup’s fresh new fund, which is an investment vehicle that hopes to plant $250,000 checks into over 100 companies.

The big twist of the fund is its approach in using quantitative factors to decide which startups to invest in. I then reported that his team tracks the velocity of hiring demand for a startup, looking at how many job applications a single company gets within a specific period of time. The signal strips out factors like investor bias, the founder’s networks and even buzzy valuations.

Here’s what’s new: The fund has deployed about $6 million, about a third of the fund, across 530 startups since December, with over 35 larger checks into high-signal startups. Othman says that the fund’s larger checks have been going toward women and minority founders at a higher percentage of total portfolio composition than venture at large. Othman estimates that their portfolio is nearly 20% women.

“As you know, we intentionally practice venture investing in a distinct way … our largest portfolio allocations are toward founders who write back to a cold outreach email, which requires quite a bit of faith on their part,” he added. It lines up with what he said last year, when he described the firm’s cut-and-dry cold email approach as “less adversarial” than other funds out there.

- Everything you need to know to make a great startup pitch deck

- 3 keys that unlock data-driven fundraising

- Pitch Deck Teardown: Front’s $65M Series D deck

- Some institutional LPs have started pulling back from VC, but most won’t

Image Credits: Javier Zayas Photography (opens in a new window) / Getty Images

THE TECHCRUNCH DISRUPT 2022 AGENDA IS OUT

Wait for it. See it? Yep, I’m excited too. And while we’re on the topic of housekeeping, some more notes:

- Listen to TechCrunch’s podcasts, including our crypto-focused show that goes by Chain Reaction, and founder-focused show that goes by Found. The TechCrunch Podcast also continues to entertain the heck out of me, so pay attention to all the good shows that they’re putting out.

- Remember that TechCrunch Live is on a brand new platform, and we’ve made it easier to apply for pitch practice. Investors (and my inbox) can attest to the importance of brevity, savviness and clarity in pitches so it’s great to see. Startups can now apply any day, any time for Pitch Practice by completing this form.

- TechCrunch Live is coming to Minneapolis. On September 7, come hang with the TechCrunch crew as we interview the best and brightest in the city. Minneapolis is among the top cities in the Midwest to start a company — and soon you’ll learn why!

- Go mining for opportunity at TC Sessions: Crypto, this November in Miami. Yep, you heard it right, we’re making it to Miami.

Seen on TechCrunch

Landa can make you a landlord with just $5

What we expect from Apple’s iPhone 14 event

Reviver is building a company one license plate at a time

Randomly selected quotes from Zuck’s very, very long interview

Shuffles, Pinterest’s invite-only collage-making app, is blowing up on TikTok — here’s how to get in

Seen on TechCrunch+

A Gen Z VC speaks up: Why Gen Z VCs are trash

The majority of early-stage VC deals fall apart in due diligence

Investors detail their red (and green) flags for startups seeking venture dollars

Is there no bottom to the SPAC mess?

Stop sensationalizing the ‘collapse’ of VC: Look at the data

And just like that, another week comes to an end. This was a weird one. I met one of the most famous actors in the world, went viral on Twitter and ate amazing pasta at Che Fico. This newsletter feels more and more like a weekly diary entry on the wacky world that we’re all in, half-baked stream of consciousness and all. Thanks for reading along, and enjoy the long weekend.

DUOS