High-growth companies often set significant goals, knowing full well that the idea of “overnight success” is for the storybooks. However, there is no better time than the middle of a market downturn to start planning for the leap from a private to a public company.

De-risking the path to going public requires strategic planning, which takes time. Companies with goals to go public in less than three years must therefore plan for it now — despite the downturn — to get the running start they’ll need to navigate the open market.

Let’s explore why this adverse economy is ideal for planning an IPO and what to do about it.

Growth investors have recently pulled back

While some companies delay their IPOs, others can play catch-up and prepare for the time when the open market itches to invest again.

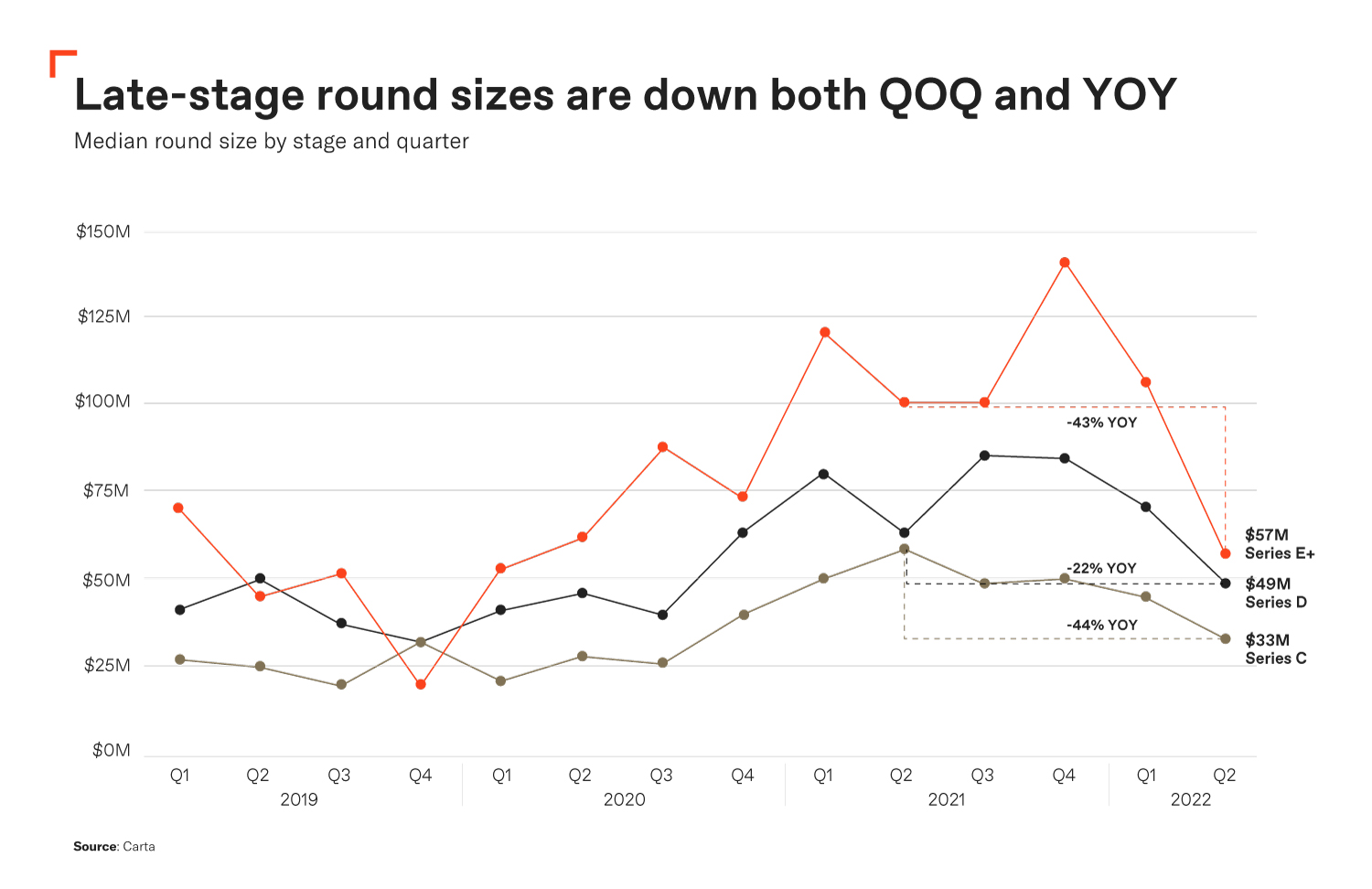

Carta reports that private fundraising levels have declined across the U.S. from a record-breaking 2021. Unsurprisingly, late-stage companies have experienced the brunt of this blow.

Market experts are currently encouraging leaders not to pin their hopes on venture capital dry powder, even though there’s plenty of it. As the graph below indicates, the size of late-stage funding rounds has shrunk.

Image Credits: Founder Shield

Although few enjoy market downturns, how this one unfolds can deliver insights to late-stage companies that pay attention. On one hand, many leaders are embracing the message of the Sequoia memo. We can agree with their ideas to prioritize profits over growth — scaling is different from what it used to be, and we must swallow that jagged pill.

On the other hand, cost-cutting and giving up hope of fundraising isn’t all doom and gloom. After all, when there is money to be found, some innovative founder will find it. We see it every day; only now, the path looks different.

Market downturns spur valuation corrections

Course-correcting is a concept frequently discussed amid market downturns. The pendulum swings one way for a period, then begins its journey toward a more balanced standard. In this case, the open market thrived on bloated valuations — most startups were overvalued before 2021.

Furthermore, many stated that 2021 was a miracle year, especially as VC investment nearly doubled to $643 billion. The U.S. sprouted more than 580 new unicorns and saw over 1,030 IPOs (over half were SPACs), significantly higher than the year before. This year has only welcomed about 170 public listings.

High-growth startups should start de-risking their path to IPO now by Ram Iyer originally published on TechCrunch

DUOS