Qatar hosting the World Cup has drawn widespread criticism over its record on rights for women, LGBTQ+ groups and migrant workers. The attendance of officials, teams, even fans has been questioned. But our connection with Qatar goes way beyond the current tournament, touching most of our lives.

Some may query if we are right to foster such ties with a regime whose values may appear to be at odds with British ones.

At the core of that relationship is gas. Qatar is a tiny country about the size of Yorkshire but it has one of the largest natural reserves on the planet – and the UK is a key customer.

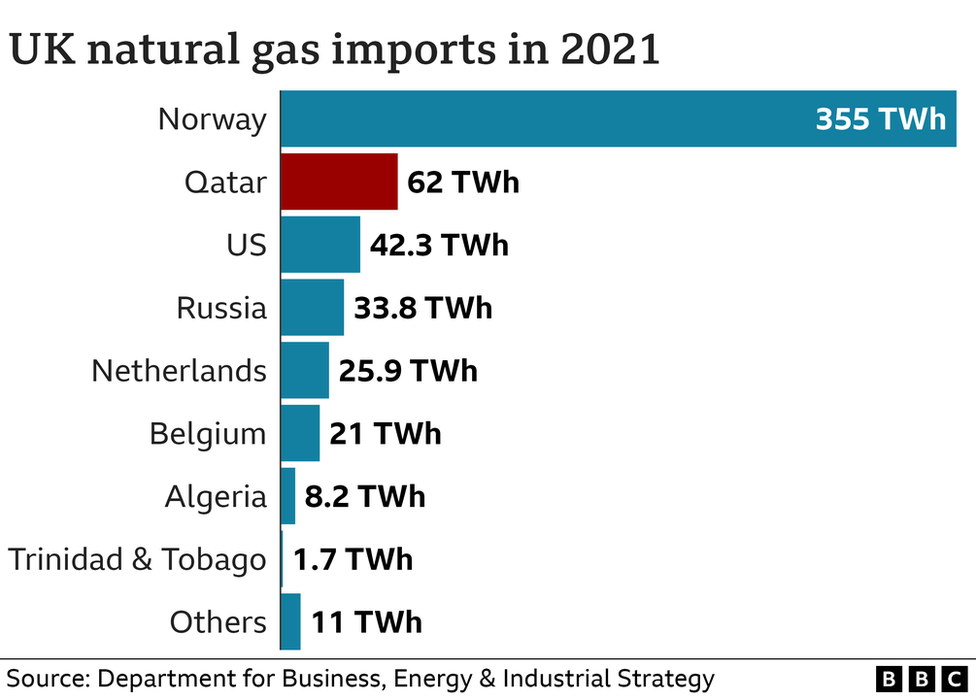

About half our gas is imported and about half of that comes via a pipeline from Norway. But Qatar is second on that list supplying about 9% of our energy imports. In theory, that’s the amount needed to power the boilers of around a million British homes. In the space of less than 20 years, Qatar has become a vital part of our energy mix.

The UK and Qatar may have few historical links – but the latter has channelled its booming gas-based wealth into embedding itself into the UK’s corporate and property landscape, and cementing a relationship with the top tiers of British establishment.

Its monarch, the Emir, was one of the few Gulf leaders to attend the Queen’s funeral. The current King accepted a donation for his charitable foundation worth over £2m (part of which was allegedly handed over in Fortnum and Mason’s carrier bags) from a former Qatari political leader in 2015.

Highly unusually, our nations’ air forces have formed two joint squadrons – one of which is patrolling the skies above World Cup venues.

And in September, Qatar took ownership of 24 fighter jets built in Lancashire, part of a £5bn deal with BAE systems.

On the ground, the Qatari government has been recycling some of its cash by investing in the UK. It’s not one of our largest investors – but its holdings are strategically chosen to maximise profile and influence. It is among the dozen biggest property owners in Britain.

Central to its property empire is the Canary Wharf Group which owns landmarks including 20 Fenchurch Street, nicknamed the Walkie Talkie, and the Shell Centre redevelopment on London’s South Bank.

The Qatari government also owns luxury department store Harrods and 5* hotel Claridge’s in London.

And in our day-to-day life it has significant shareholdings some of our biggest brands. Bank with Barclays, shop at Sainsburys or use Heathrow airport, and Qatar benefits. Turn on the tap as a Severn Trent water customer, and your bill adds to its profits.

In total, Qatar’s state investment arm has invested about £40bn, in areas which touch millions of British lives, and designed to ensure the influence of that tiny country punches far above its weight on British soil.

And its funds our government has welcomed – and is keen to boost. In May, then Prime Minister Boris Johnson trumpeted an agreement for Qatar to invest up to £10bn over the next five years in the UK in sectors from cybersecurity to life sciences.

Meanwhile, our reliance on Qatari gas could rise in the future. The UK government has been nurturing the relationship with Doha, to ensure security of supply as North Sea reserves dwindle.

Britain in recent months has succeeded in cutting out imports from Russia. That was only about 4% of the UK total – but it makes the gas we source from Qatar even more crucial.

The EU is far more reliant on Russian gas so securing alternatives is even more pressing.

Overall, the EU only got 5% of its gas from Qatar – but that could change. Olaf Scholz, chancellor of the bloc’s biggest gas guzzler – Germany – has said that Qatar will play a central role in the country’s strategy to diversify away from Russian gas. But it won’t happen overnight.

Contract negotiations have been tricky. Qatar likes to supply gas under long-term deals, lasting 15-20 years, which may not be consistent with Western nations aims to decarbonise.

By contrast, China, with its less ambitious net-zero plans, has unveiled a 27-year agreement to buy a massive $60bn worth of Qatari gas. And Germany needs to boost its infrastructure, the terminals which receive the liquified natural gas – known as LNG, in order to take on more supplies.

The UK is ahead of the game in the latter – thanks to cooperation from Qatar. The country is a majority owner of the South Hook terminal in Wales, where LNG is offloaded into special containers. It’s claimed the site can hold a fifth of the UK’s daily gas needs – the Qatari government is investing millions to up that capacity by a quarter by 2025.

And by that point, Qatar is expecting to double its LNG output – with no shortage of customers. Many Asian nations are vying with Europe to tie down supplies to ensure energy security – and Qatar is seen as a relatively reliable and geopolitically tame option. The alternatives may not be attractive: for example, while part of the world’s largest gas field falls in Qatari water, the rest lies in Iran’s (the two countries produce gas independently).

Some of us may not be able to locate the country on a map but our relationship with Qatar seems set only to become closer in the years to come.