Insite AI, a platform for consumer packaged goods companies that uses AI to provide recommendations on how to price, distribute and promote their products in physical stores, today launched out of stealth with $19 million in Series A capital from NewRoad Capital and M12, Microsoft’s corporate venture arm. Co-founder Shaveer Mirpuri says that the funding will be put toward customer onboarding, building a team of industry experts to help shape product initiatives and an expanded feature set.

Mirpuri and Jonathan Reid co-launched Insite with the belief there was a large addressable market for brick-and-mortar sales revenue growth management software. It’s true retailers — and by extension, brands — face considerable challenges in this area, particularly as the economy takes a precipitous turn. According to NPD, more than 80% of U.S. consumers said in May that they’d rein in product spending within the next three to six months. Major retailers like Walmart and Target have lowered their sales and profit guidance in response, reflecting the struggle to move inventory from warehouses.

“Brands have a fundamental business need to achieve stronger influence, collaboration and execution with their major retailers. They are always seeking out ways to cost effectively and rapidly produce must-have answers — well ahead of time — on the performance of scenarios in strategic portfolio design, budget planning, assortment, space, pricing and trade fund strategies,” Mirpuri said. “The pandemic exacerbated the need for even further clarity in decision making due to constant changes and volatility in shopping behavior and manufacturing.”

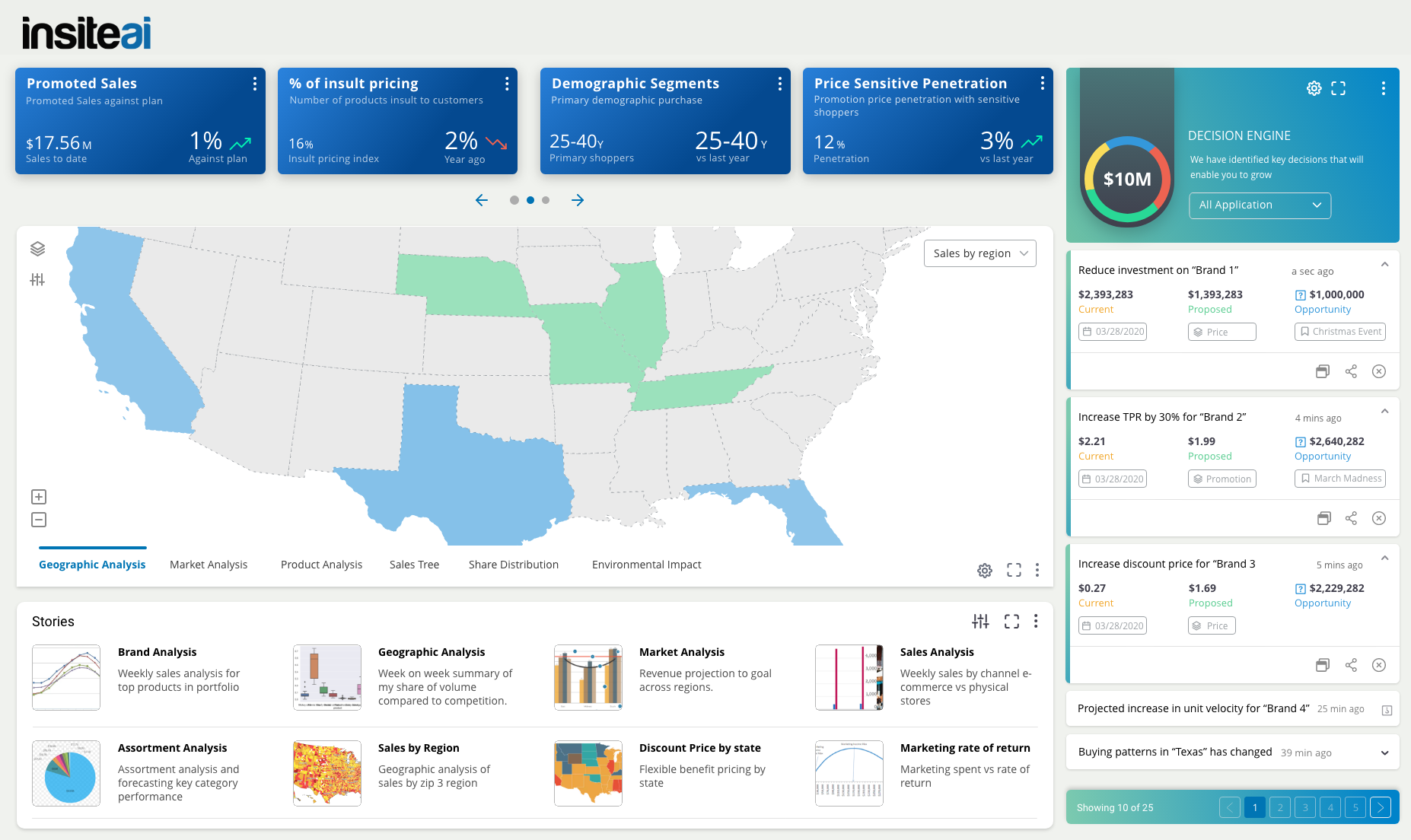

That’s where Insite comes in. The platform — hosted on a customer’s cloud environment — aims to help brands make product and inventory assortment and pricing decisions across retail stores, using data derived from different retailers, sales, supply chains and market segments. Insite synthesizes the data to create simulations for optimized assortment and trade promotion plans, attempting to forecast the performance for each product, store and day of the week and providing explanations for factors affecting demand and price elasticity.

Image Credits: Insite AI

Several startups are coming at the same problem from different angles, like Hivery, which sells software that optimizes product placement on store shelves. Cosmose’s software analyzes foot traffic to help retailers create marketing campaigns. There’s also Lucky, which provides insights into real-time inventory distribution and discovery.

But Mirpuri sees consulting firms as Insite’s primary competitor — a competitor he argues falls short in several aspects.

“Consulting firms advising consumer brands tend to perform single engagements that are slow and costly. Existing category and revenue growth management tools from data providers are afterthought add-ons and lack predictive capabilities,” Mirpuri asserted. “Furthermore, those solutions aren’t customizable to the intricacies of each brands’ planning and retail-driven execution needs and are constrained in working with inputs necessary to provide truly powerful insights and decisions …”

Whether that’s the case depends on the consulting firm in question and their customer. But setting aside the merits of Mirpuri’s sales pitch, it was enough to win the business of more than two dozen customers, he says, including 10 of the world’s largest 30 consumer brands.

Mirpuri declined to share revenue figures. But he said that Insite plans to double its headcount over the next 12 months as it prepares to open a new office in Bentonville, Arkansas, where the company is headquartered.

“As consumer shopping behaviors, economic uncertainty and post-pandemic supply chain issues present new challenges for brands daily, the need for a fast, comprehensive category management solution is more important than ever,” Mirpuri said. “We are seen as [the] solution of choice.”

One headwind Insite might have to overcome is funding uncertainty extending well into next year. Global investment in retail technology dipped 11% to $23.8 billion in Q1 2022 compared to $26.6 billion in Q4 2021, according to CB Insights. While store management technology saw a bump in funding, increasing by 10% to $2.3 billion quarter over quarter, it remains to be seen whether it’s a lasting trend.

M12 partner Abhi Kumar, for one, believes Insite is in a position of strength. He notes that the company currently manages more than $80 billion in revenue for its customers, making decisions for nearly 20 billion units of products.

“Insite AI is the ‘magic’ that algorithmically shapes trade between the world’s most purchased products and the world’s most shopped retailers,” said Insite AI board member and M12 partner Abhi Kumar. “At M12, we make investments in industry disruptors, and we firmly believe that Insite AI is the leading innovator using AI and data to help consumer brands win by enriching collaboration with their retail channels. Insite AI has changed the concept of category and revenue growth management in consumer brands.”

Insite AI raises $19M to help consumer brands figure out their in-store strategies by Kyle Wiggers originally published on TechCrunch

DUOS