Cinchy, a startup that provides a data management service for enterprise customers, today announced that it raised $14.5 million in Series B funding led by Forgepoint Capital with participation from IVP, SUV, Techstars and Mars. Bringing the company’s total raised to $24 million, the capital will be put toward scaling Cinchy’s outreach and continuing to invest in the startup’s core technology, CEO Dan DeMers told TechCrunch in an interview.

“Data management remains an expensive chore, and a proliferation of apps producing an ever-increasing volume of data only adds to the challenge. As a result, rather than being a business driver or competitive advantage, data is more often a drain on IT budgets and a nightmare for compliance teams,” DeMers said. “The Cinchy platform addresses many of the challenges associated with today’s IT environments, specifically those defined by data silos, data copies and complex code.”

DeMers co-founded Cinchy with Karanjot Jaswal in 2017 with the ambitious goal of abstracting away data integration processes. DeMers was previously the director of prime finance and futures technology at Citi, where he built and managed a tech delivery and support services group for brokerage. Jaswal was also at Citi, working on the data warehouse team on risk and margin.

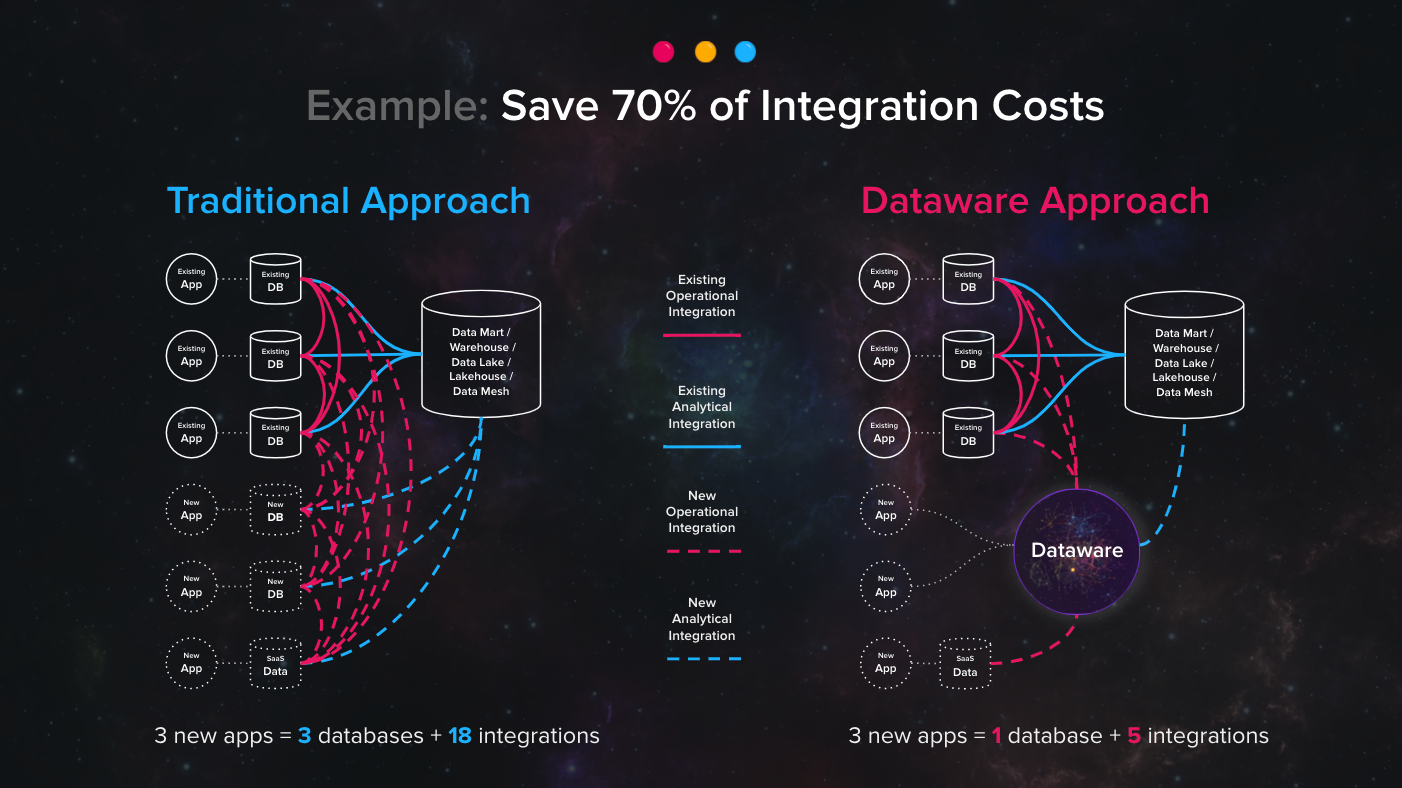

Both DeMers and Jasawal perceived that companies were struggling to overcome data integration hurdles. To their point, in a recent IBM survey, 40% of IT leaders said their data integrations are getting too expensive while 19% believe their current data integration solutions can’t handle all data sources.

“The existing app- and API-centric architecture requires individual apps to manage their own data, and this means every new app or API adds yet another data silo,” DeMers said. “It’s like a tax on innovation that only gets worse with every new solution that’s delivered.”

Cinchy aims to solve this by enabling organizations to decouple data from apps and other silos by connecting them to a “network-based” platform. Project teams first connect data from core systems, software-as-a-service apps and spreadsheets to the platform — Cinchy handles things like data backup, data versioning and data engagement tracking without actually hosting the data. Admins can access the platform to view, edit or query data for individuals and teams. Other users with the right permissions can engage with the data to build data models.

Image Credits: Cinchy

Cinchy uses the platform itself to run its business. Employees have self-serve access to discover, query, create and change data, DeMers says. Changes to data are version-controlled, access-controlled and available to apps and users based on granular controls.

“Anyone who’s experienced the collaboration and efficiency of collaboration tools like Google Drive and Docs will understand the significance of bringing those capabilities to organizational data,” DeMers said. “The outcomes in terms of speed, efficiency, control and creative problem-solving are staggering.”

DeMers sees Cinchy competing with any vendor that promises to simplify data integration. There’s a fair number out there, including Equalum, Airbyte, Hevo Data and Jitsu — all chasing after a market that could be worth $22.28 billion by 2027. Demand for data integrations solutions certainly appears high, with a 2020 survey from Dresner Advisory Services finding that 67% of enterprises were relying on data integration to support analytics and business intelligence platforms and that 24% were planning to in the next 12 months.

But DeMers argues that most are focused on workarounds to better deal with data fragmentation, particularly in the context of analytics. “Most products that may be seen to be competing with Cinchy are in fact only exacerbating the challenges to agility and compliance associated with data integration,” he said.

Rivals no doubt disagree. It’s true, though, that Cinchy has a growing customer base, particularly in the financial industry — suggesting that it’s winning over businesses. Adopters span institutions like TD Bank, National Bank and Natixis; Cinchy recently launched a credit union edition of the platform to better serve financial institutions.

“Organizations everywhere are looking for ways to save money while continuing to capitalize on market opportunities with new solutions. This is why we’re confident that the Cinchy platform will increasingly appeal to chief experience officers and team leaders tasked with bridging these priorities,” DeMers said. “Cinchy … enables organizations to liberate their data from applications, spreadsheets, and other silos and make it [available] for real-time collaboration whenever and wherever it’s needed.”

Toronto-based Cinchy, which has just over 50 employees, is currently hiring.

Integration platform Cinchy lands fresh cash to connect data sources by Kyle Wiggers originally published on TechCrunch

DUOS