Venture fundraising has continued at a robust pace, but much less cash is being deployed.

Let’s start with a few headlines:

- Bessemer in September raised about $3.85 billion for early-stage startups, the largest vehicle in the firm’s 50-year existence.

- Insight Partners in February raised over $20.0 billion, double its predecessor fund (closed in April 2020 at $9.5 billion).

- Lightspeed in July raised more than $7 billion across four funds for seed to Series B rounds.

- Battery Ventures in July raised over $3.8 billion with a broad mandate.

- Founders Fund in March raised over $5 billion across venture ($1.9 billion) and growth ($3.4 billion) funds.

- a16z in May raised about $4.5 billion in its fourth fund targeting blockchain, bringing its total funds raised for blockchain-related companies to more than $7.6 billion.

- a16z separately closed $9 billion in fresh capital in January, with $1.5 billion allocated to biotech investments.

- Tiger Global is rumored to be raising PIIP 16 in what could be around a $10 billion vehicle and its second-largest fund ever.

The public markets have seen an extreme valuation recalibration, and it’s effectively trickling down into the private markets. All the while, crossover funds and VCs have been watching from the sidelines — capital deployment is in somewhat of a “wait and see” mode.

The net/net: More dollars being raised with less deployed equals materially higher cash balances.

Image Credits: Irving Investors

What the numbers tell us

Capital raising

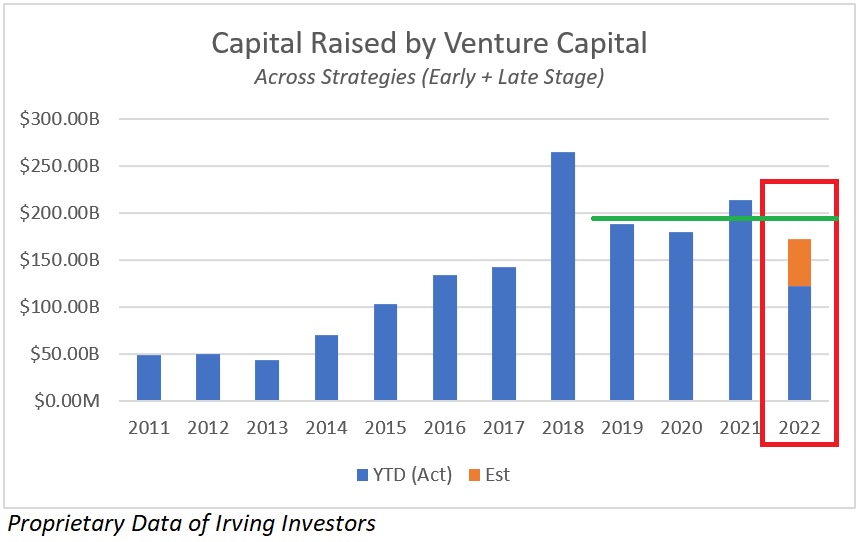

Venture capital fundraising has remained somewhat constant this year. VC firms have raised a total of $122 billion so far this year and are on pace to finish the year with $172 billion.

Short-term valuation “work arounds” can become much bigger long-term problems.

That’s 20% less than 2021 ($214 billion), a touch below 2020 ($180 billion) and about 11% less than the $194 billion average raised annually since 2019.

This strong level of fundraising is in stark contrast to the poor performance of high-growth names in the public markets. For instance, our high-growth SaaS bucket has suffered losses of about 60% to 80% or more.

Image Credits: Irving Investors

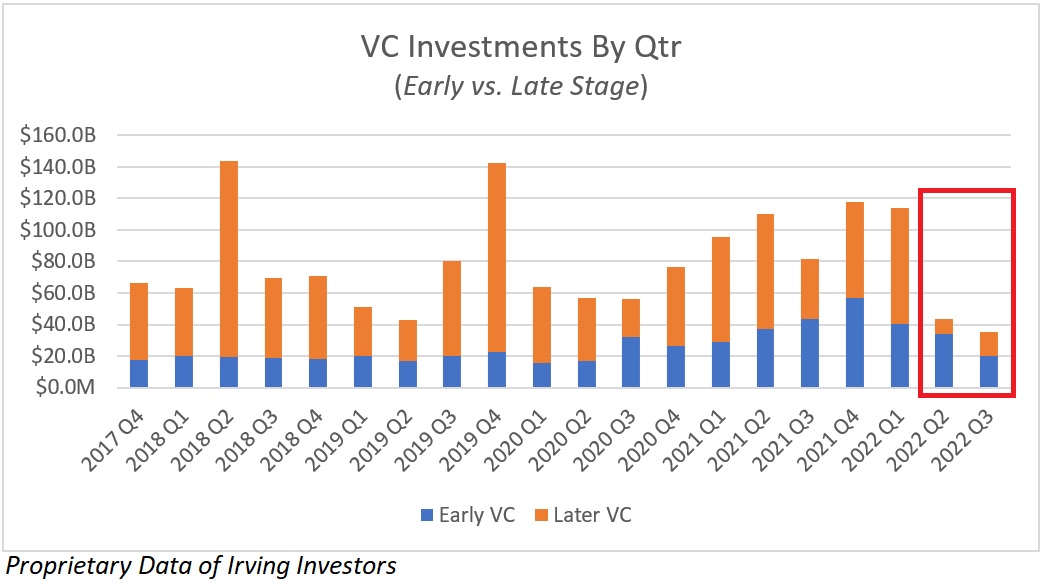

Capital deployment

Total capital deployed by VCs in Q2 2022 and Q3 2022 has rapidly declined and now averages just $39 billion per quarter. This is on track to be the lowest reading since we can pull the data from 2017.

Currently, capital deployed in Q3 2022 (less than $40 billion) is on pace to be about 70% below Q4 2021 levels (about $118 billion).

Investors are sitting on mountains of cash: Where will it be deployed? by Ram Iyer originally published on TechCrunch

DUOS