The newly announced debt restructuring measure by government has not gone down well with some stakeholders.

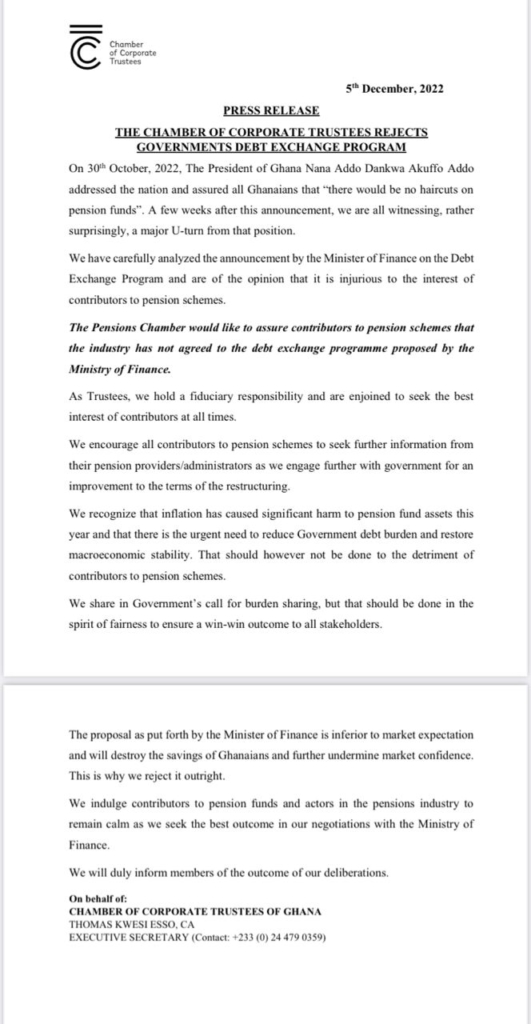

The Chamber of Corporate Trustees of Ghana has rejected the Domestic Debt Exchange Programme which was geared towards restoring the nation’s capacity to service its debt.

Finance Minister, Ken Ofori-Atta indicated on December 5, that the objective was “to invite holders of domestic debt to voluntarily exchange approximately ¢137 billion of the domestic notes and bonds of the Republic, including E.S.L.A. and Daakye bonds, for a package of New Bonds to be issued by the Republic.”

But the Chamber of Corporate Trustees begs to differ.

In a press release on Tuesday, the Chamber believes the structure will do more harm than good to investors under its umbrella.

Their fear is borne out of the President’s initial position that there would be no haircuts, a position which has changed a few weeks on.

“On 30th October, 2022, The President of Ghana Nana Addo Dankwa Akuffo Addo addressed the nation and assured all Ghanaians that “there would be no haircuts on pension funds”. A few weeks after this announcement, we are all witnessing, rather surprisingly, a major U-turn from that position.”

The Chamber further insists that the Domestic Debt Exchange programme will not auger well for pension contributors.

“We have carefully analyzed the announcement by the Minister of Finance on the Debt Exchange Program and are of the opinion that it is injurious to the interest of contributors to pension schemes,” the statement read.

On the back of this, they explained that “the Pensions Chamber would like to assure contributors to pension schemes that the industry has not agreed to the debt exchange programme proposed by the

Ministry of Finance.”

The statement was signed by the Chamber’s Executive Secretary, Thomas Kwesi Esso.

Furthermore, the group says though it acknowledges the negative effect of inflation on the pension fund assets, the need to reduce government’s debt burden “should however not be done to the detriment of contributors to pension schemes.”