Yesterday, Fingo, a YC-backed Kenyan fintech, launched its neobank, which it developed in collaboration with Pan-African financial institution Ecobank Kenya. The Ecobank subsidiary unveiled the neobank, the first of its kind in the East African country, according to the pair, in an event with the country’s president, William Ruto, in attendance.

It’s taken a while for Fingo to get here since CEO Kiiru Muhoya and his co-founders James da Costa, Ian Njuguna and Gitari Tirima founded the Kenyan outfit in January 2021 to provide financial services that appeal to a fast-growing African youthful population that happens to be the youngest globally but the most financially marginalized.

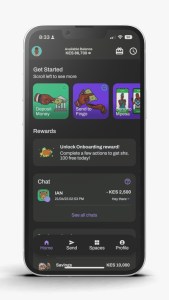

For young adults in Africa, opening an account can take several hours to days, with multiple in-person interactions and requirements to bring physical paper documents. In addition, they have to deal with expensive fees to send money and maintain their accounts. Yet, they still struggle to access savings, insurance and credit, financial services Fingo promises to deliver to its users; however, it is currently pitching them cheaper transfer fees, subsidized rates at pay bills, cash-back rewards and other features, including payment links and tailored savings plans.

After a $200,000 pre-seed round, Fingo got into YC S21 and raised $4 million in seed funding toward the end of that year. Multistage venture capital firm HOF Capital led the round with participation from Hustle Fund, Pioneer Fund, TCVP, Launch Africa, Chandaria Capital, Naiban (Nairobi Angel Network), Chui Ventures, as well as from the co-founders of Monzo and Twitch and executives from Google, Facebook and Paytm. What followed was a signed partnership with Ecobank, and Fingo began integrating its software with the bank toward launch while simultaneously waiting for regulatory approval from the Central Bank of Kenya (CBK), which finally came in Q1 this year.

The Fingo App

Before giving the green light, the CBK, all that time, tried to understand the framework Fingo and Ecobank had set up for their relationship, especially as it concerns data, transactions and customer interactions. Unlike Nigeria, where collaboration between banks and fintechs is commonplace, allowing the latter group to launch fast (ultimately contributing to why the country has attracted most of Africa’s fintech funding), it is few and far between in Kenya. Fingo claims to be the first Kenyan neobank, so it’s pretty understandable, looking at how long it took to get approvals and go to market.

Meanwhile, Muhoya noted on the call that despite the wait, the fintech still has the majority of its venture capital it raised in the bank because it maintained its 15-man headcount and barely had any expenses other than paying salaries and developing its software. So it isn’t raising additional capital for operations, especially in this challenging fundraising environment.

Now that the partnership has been approved, the Fingo Africa app will offer its users a bank account “under 5 minutes,” paired with free peer-to-peer transactions and immediate access to multiple services such as savings, financial education and smart spending analytics, the company said in a statement. The fintech says it has acquired a waitlist of 50,000 customers within 24 hours of launch. However, it will have its work cut out for itself if the plan is to onboard millions in a market where mobile money reigns supreme (Safaricom’s M-Pesa controls over 90% of that medium) and a banking sector dominated by the likes of KCB and Equity Bank (which have their digital banking products).

Fingo’s partnership with Ecobank, which claims to have the most significant footprint of any bank in Africa, covering over 30 countries, might provide the scale the fintech needs outside Kenya. Both entities are planning a Pan-African rollout, with an imminent expansion to the rest of East Africa by the end of the year, according to Muhoya. Digital banking counterparts that serve consumers in that region include Finclusion and Koa.

“Our partnership with Fingo Africa is a critical milestone in our mission to equip Africa’s youth with the essential financial tools they need to succeed. Together, we will launch youth-focused financial products, including quick access to bank accounts, savings options, and cost-effective transactions, across Ecobank’s pan-African footprint,” said Diallo Djiba, Ecobank Group’s senior fintech advisor, in a statement. “We are excited to extend our current solutions through this partnership and to be at the forefront of youth banking in Africa. Our aim is to reach millions of young people across the 33+ African markets where Ecobank operates.”

Kenya’s Fingo partners with Ecobank, launches neobank on the back of $4M investment by Tage Kene-Okafor originally published on TechCrunch

DUOS