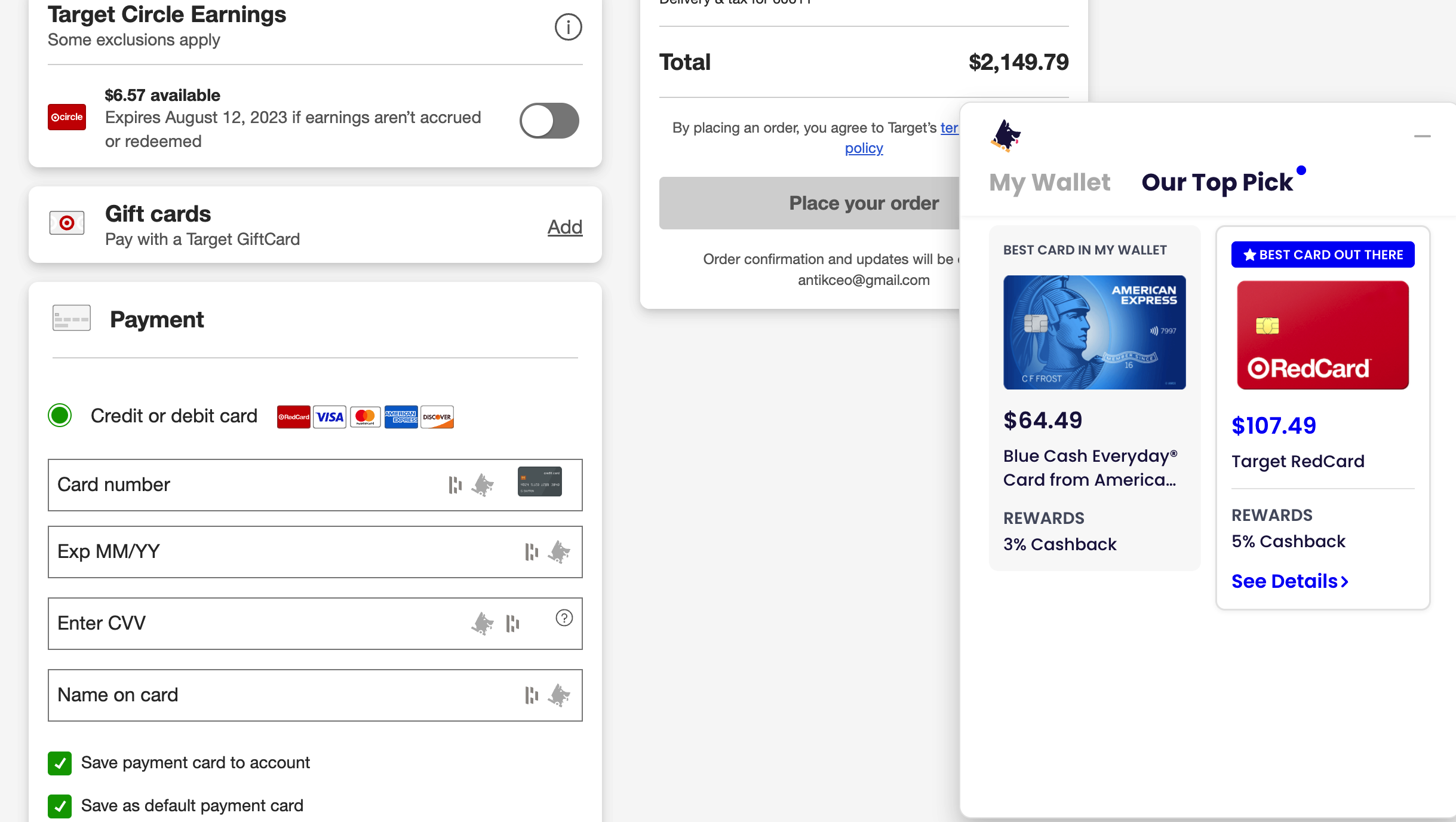

Tapping into your credit card rewards isn’t easy. You might have to read the fine print for what purchases are eligible or sign up for notifications on which ones qualify when. Kudos wants you to make the most of your wallet and pick the best card every time you are ready to make a purchase.

The company developed a free Chrome extension for a digital wallet that holds all of your cards — it supports over 3,000 — and then calculates the rewards and benefits for each purchase and recommends the right card, which could be a store card and then helps you apply for it.

Tikue Anazodo and Ahmad Ismail started the company a few years ago after working together at Google and Affirm. Ismail was a product lead at both of those companies, while Anazodo, also previously a product lead for Affirm, was product lead for Google Pay, leading the launch of its payment partnership with Shopify and scaling its launch to international markets and to over 300,000 merchants.

Anazodo told TechCrunch that the driver for Kudos was poor consumer experience. Much of his previous work was getting integrations between the company he was with and the retailer or merchant but not so much on how the end user would benefit.

“There are billions locked to credit cards, but the consumer experience was always lacking,” he added. “I wanted to take the first principles approach in what consumers care about when they shop.”

Kudos credit card recommendations. Image Credits: Kudos

He also hinted that Kudos is working on a prototype to manage the entire checkout for the user.

The company, which exhibited as part of the Battlefield 200 at TC Disrupt, announced today $7 million in seed funding from investors, including Patron, QED Investors, SciFi VC, SV Angel and a group of over 40 angel investors from companies like Google, Affirm, AfterPay, Honey, Duolingo, Discord, Earnest and Fundera. This also serves as the official launch of its mobile desktop browser extension and app.

Kudos had been in beta the past three months and didn’t have a waitlist, something Anazodo said was intentional. He wanted the company to grow organically, and it has. The company is seeing 36% month-over-month growth and 90% retention so far.

“It helps that we show up whenever they shop, so there is no reason to uninstall,” he added. “We are doubling down on capabilities and features that will drive growth, and we are also going to be doing more product-led growth, such as the ability to share wallets.”

Kudos makes money from affiliate fees when consumers finish applications and also gets some from merchants when there are cash-back rewards, sharing those with consumers, Anazodo said.

There are startups like Kard, Power, Bilt Rewards and MaxRewards also playing in this space, but Anazodo says Kudos is competing more with big players like Bolt, PayPal, Google Pay and Apple Pay. And even Sleek, which he noted is “taking a similar consumer-centric approach with no merchant integration dependency.”

How he believes Kudos differs is its focus on capabilities like ubiquity and consumer earnings. For example, the smart wallet should work everywhere rather than depend on integrations and make transparent rewards and benefits that are otherwise hidden. For example, purchase protection or lost luggage protection.

“I’ve witnessed merchant integration dependencies as the biggest crutch to scaling a consumer-focused wallet, which is why companies like Bolt and Fast require significant capital to get merchant support — they need to pay millions per merchant to drive integration incentives,” Anazodo added. “Our initial product provides a very streamlined autofill experience, including CVV, on over 1 million sites.”

Next up, this holiday season the company will launch a cash-back feature across over 12,000 merchant partners so that consumers can stack reward earnings. Kudos will also be growing its team of 11 as it spends the next six months on improving the product and acquiring customers.

Kudos raises $7M to recommend the right credit card for shopping rewards by Christine Hall originally published on TechCrunch

DUOS