Food prices are rising at their fastest rate for 45 years, with the cost of basics such as milk, cheese and eggs all surging, latest figures show.

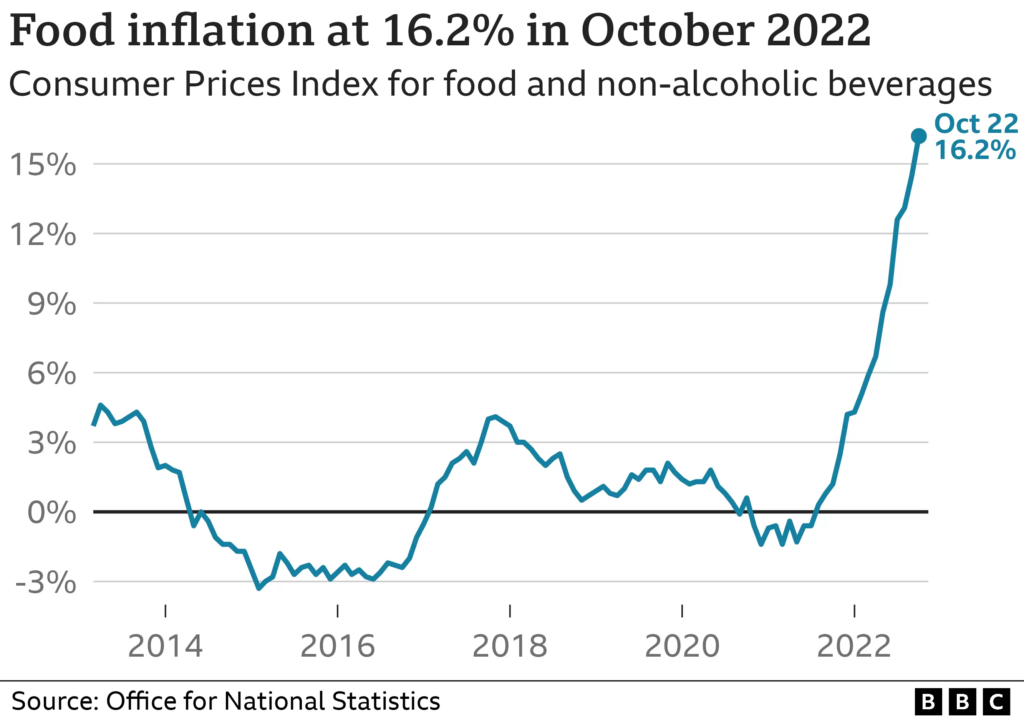

Food price inflation hit 16.2% in the year to October, up from 14.5% in September.

Energy and fuel costs also rose, helping push the overall UK inflation rate to a 41-year high.

High prices are hitting poorer people hardest, as they spend more of their income on food and energy.

The latest overall inflation figure, which is 11.1%, is the highest since October 1981 and comes ahead of Thursday’s Autumn Statement, which is expected to see Chancellor Jeremy Hunt announce public spending cuts and tax rises.

Mr Hunt said his plans will aim to bring spiralling price rises under control, adding that he would take “tough but necessary decisions” to get the economy back on track.

But Labour’s shadow chancellor Rachel Reeves said the surging inflation rate would “strike more fear in the heart of families across Britain”.

“British people feel the impact of rising inflation so much more than other countries because 12 years of Tory economic failure has left us exposed to any shocks,” she said.

Inflation is a measure of the cost of living and to calculate it, the Office for National Statistics (ONS) keeps track of the prices of hundreds of everyday items, known as a “basket of goods”.

Items such as milk, pasta, margarine, eggs and cereals were among the food items that saw the sharpest price rises in October, it said.

Grant Fitzner, chief economist at the ONS, said that over the past year “gas prices have climbed nearly 130%, while electricity has risen by around 66%”.

He said that despite the government limiting energy bill rises in October through the Energy Price Guarantee scheme, gas and electricity prices were still the driving force behind inflation.

However, the ONS estimated that without the support for bills, inflation would have risen as high as 13.8%.

As inflation rises businesses are putting up their prices and households are cutting back their spending.

The Bank of England has also increased interest rates to 3% in a bid to cool rising prices by making borrowing money more expensive. But this is driving up the cost of mortgages and other loans.

It is dragging on the UK economy which is likely to enter a recession at the end of the year.

Latest figures showed the economy contracted by 0.2% between July and September and the Bank of England has warned the UK is facing a tough two-year downturn.

A recession is defined as when an economy shrinks for two three-month periods in a row. It’s a sign an economy is performing badly, with companies often making less money and unemployment rising.

Some economists have suggested October’s 11.1% inflation rate could be the peak, with Paul Dales, chief UK economist at Capital Economics, saying prices could began to slow down “if the government continues to freeze [energy] prices in some way”.

“There is growing evidence that the upward pressure on core inflation from global factors is now fading,” he said.

“The recent falls in global agricultural commodity prices suggest to us that food inflation will soon start to ease.”

October was always going to be a very tough month for inflation. Despite the Energy Price Guarantee, which limited the rise of typical bills to £2,500 a year, inflation is at a 41-year high of 11.1%. Without the support scheme it could have been more like 13%.

But consumers don’t need to be told how wide-ranging this is, with food price inflation up again to the highest rate in 45 years, driven by milk and cheese prices.

Things will remain tough in the coming months, with the full social effect of these energy bills not yet seen because of a so far mild winter.

And yet in global markets there are the smallest signs that the initial impetus for the spike in inflation a year ago, the post-pandemic supply chain problems, are starting to turn. China’s slight easing of its zero Covid lockdowns also suggests some light at the end of the tunnel.

This inflation figure should be the peak, but we have been at this point before.

Energy prices remain harsh, but much will depend on tomorrow’s announcements from the chancellor. So inflation will stay very high for a few months at least, as it takes some time for these global factors to feed into everyday prices.