When Ankur Nagpal sold Teachable for a quarter of a billion dollars, he felt lucky. Then, he quickly felt lost when trying to navigate the financial systems of a country he wasn’t born in and learn the institutional language often only spoken fluently by the historically wealthy.

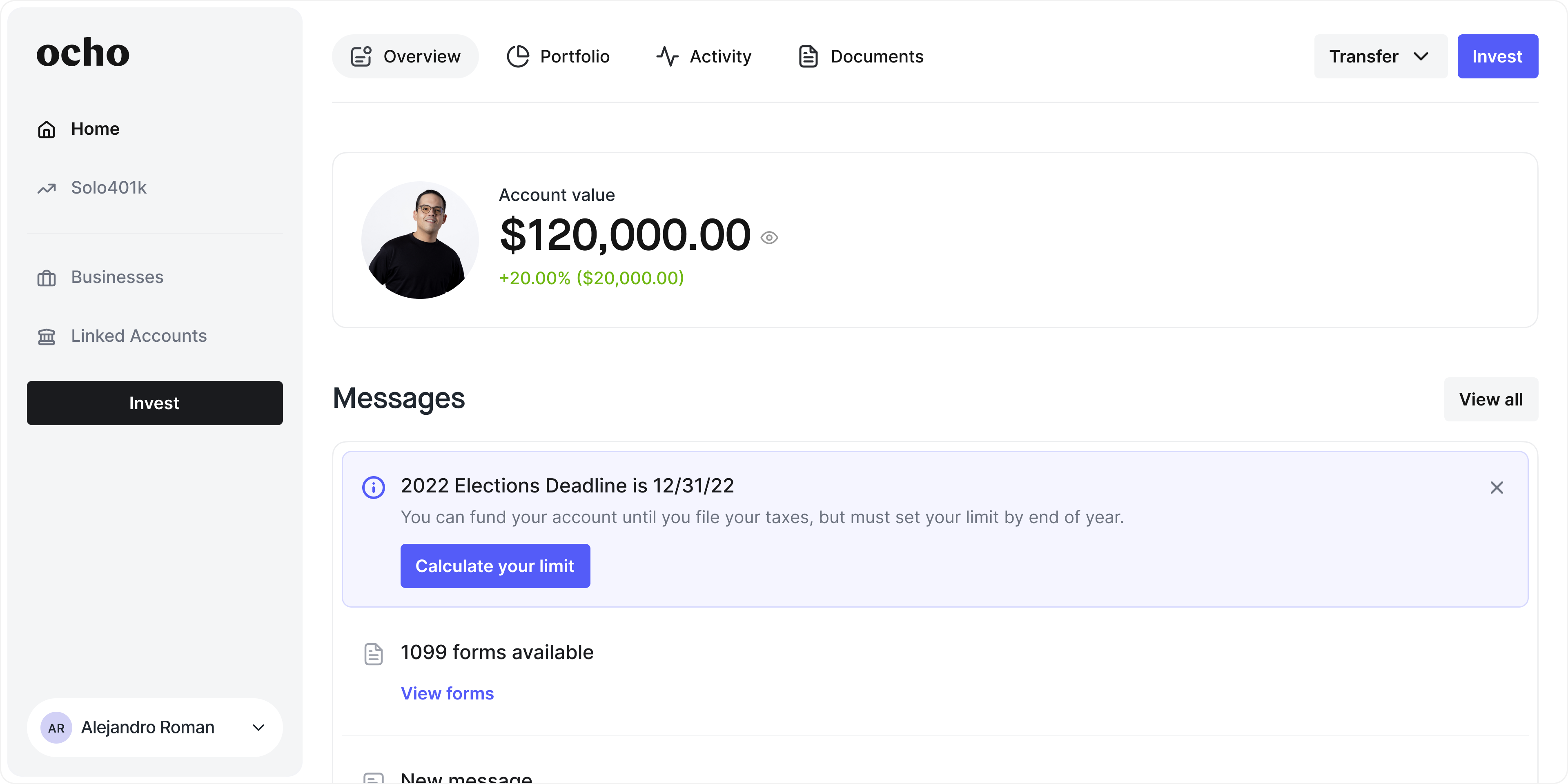

It would be a few years of self-employment, and building a venture firm later, before Nagpal returned to the moment as one of the early catalysts for his newest startup, Ocho. The company, launching publicly today, wants to make it easier for business owners to set up and manage their own 401(k) retirement accounts.

Personal finance is hard – and that’s a tale as old, and difficult to disrupt, as time. And while Nagpal agrees that there’s no “north star” company that has shown how to tackle finance literacy at scale, he’s hoping that Ocho’s 10-person team may just have a not-so-boring wedge that changes that.

Ocho is joining the several fintech companies out there that aim to modernize, and really rebrand, the retirement account away from traditional providers like Charles Schwab or Fidelity, or expensive solutions like lawyers and consultants.

“I’ve started exploring the space, and we realize everyone – like Robinhood to Coinbase – is just spending unsustainable amounts of money to acquire customers, but are making no money themselves and continually sort of need these large funding rounds just to exist,” Nagpal said. “I’m actually expecting there to be a very rough 6, 12 or 18 months for fintech companies specifically.”

Ocho’s twist from competition, he thinks, is in its market focus. “There’s so many companies targeting startup founders and their wealth – there’s literally a new one launching every month or two all backed by big name VCs, but no one is focused on the business owner that is otherwise doing well but is not a startup founder or a startup employee,” he said.

Instead, Ocho is leaning into Nagpal’s background of working with creators when he was building Teachable. Teachable helped creators build revenue streams, Ocho wants to help those same creators take their earnings and invest, harvest and scale them in a smart way.

“At Teachable, we helped these people make money online and now there’s lots of places for creators, freelancers and entrepreneurs to make money online – but how do we help them think about building wealth?” Nagpal said. The long-term vision for Ocho is to offer products, beyond solo 401(k)s, that help business owners build wealth.

Human Interest is one of Ocho’s closest competitors; raising $200 million at a $1 billion valuation last year. Nagpal says that Ocho differentiates itself because its focused more on individuals, freelancers and creators, instead of Human Interest’s target of small and medium-sized businesses.

For now, Ocho is charging a flat $199 annual fee to help individuals start their retirement account. It takes about 10 minutes to set up, and 48 hours to get final confirmation.

The big challenge for the startup is getting the right solopreneurs to care about their retirement accounts. Its look for people who have income-generating businesses, but don’t have any full-time employees. If you have a side gig alongside your full-time job, you can create a 401(k) just for the side hustle, but can’t put full-time income into the retirement account.

Image Credits: Ocho

Nagpal thinks he can nail early adoption through smart education material and outreach, referring to personal finance trends on TikTok as an example of consumer demand for more information. He says that 40% of the Ocho staff is working on marketing or education, and that the balance will be retained even as the company scales.

If education is so important to getting Ocho to work, one may wonder why it’s launching with a fintech product. The answer is simple: deadlines. Users need to make a retirement account by December 31, 2022, if they want one for 2023 – which puts the fintech in a relevant, but time pressed, position.

Nagpal isn’t worried about the seasonality of the 401(k) product because of the upcoming product roadmap, which includes the education product, investment flows into the retirement product like being able to invest in startups and ETFs, and even HSAs, often described as a 401(k) for healthcare.

To power that ambitious product spree, Ocho has raised $2.5 million from Nagpal’s own venture firm, Vibe Capital. The entrepreneur says that he raised the $60 million debut fund for Vibe Capital with the idea that he would incubate a startup or two out of the firm, which materialized today now that it owns 20% of Ocho.

Nagpal admitted that the idea of a founder using his own venture firm to seed his own startup may appear to be the “mother of all conflicts of interest” but reasoned that it was everything but. He emailed all LPs in his fund about the investment, got a unanimous yes, and ended up raising at a much lower price for the startup than if they had gone out into the fair market. It’s still uncommon to see founders sell a company, start a venture firm and then use that same venture firm to seed their next company.

Perhaps the unique connection between Nagpal’s first company, to his firm, to his newest startup, could hint at what his approach to personal finance may be: diversify across multiple vehicles, redefine what a supercharged investment could look like, and keep on learning.

Ocho’s starting team.

Ocho wants to rethink (and rebrand) personal finance for business owners by Natasha Mascarenhas originally published on TechCrunch

DUOS