There is very, very little room for error in aerospace and defense (A&D) manufacturing. For companies that build products like missiles, rocket boosters and avionics, each part must not deviate more than a hairsbreadth from its technical specifications.

Despite the precise demands of the industry, however, parts ordering is generally done using systems that are only slightly better than carrier pigeon: generally some combination of Microsoft Excel spreadsheets, long text PDFs attached to email, or an A&D company’s internal portal. Communication between companies and suppliers about these highly technical parts can also be bogged down by similarly low-tech, human-driven errors, like forgetting to copy someone on an email.

“I had this crazy theory that nothing can really move forward in terms of automation until all of that text, all of those decisions, get digitized,” Malory McLemore said in a recent interview with TechCrunch.

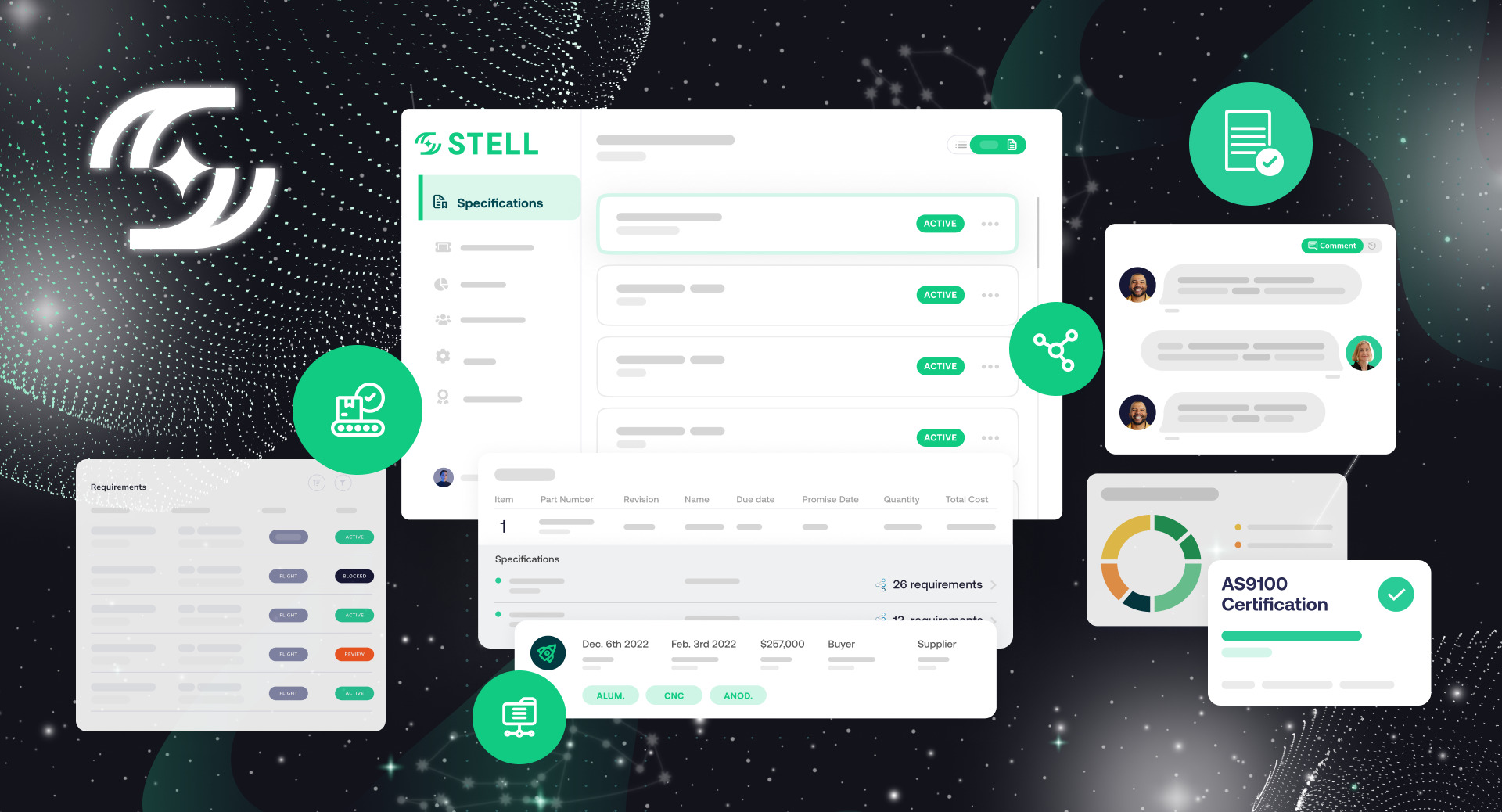

To solve this problem, McLemore and Anne Wen founded Stell, a startup that’s building a platform to bring new workflows to parts ordering. The company, which is less than six months old, just closed an oversubscribed $3.1 million pre-seed round led by Wischoff Ventures and Third Prime VC as it gears up expand its team and build out its product. The company is hoping that its platform can reduce error and improve efficiency – two variables that will be key to shoring up America’s industrial base.

Forming a plan

Stell was still just a “crazy theory” when McLemore embarked on an MBA at Harvard Business School. That’s where she met Anne Wen, a fellow graduate who had experience getting space startups off the ground. The idea continued to germinate, but ultimately both McLemore and Wen completed the program unsure of how to move forward.

“We left school feeling like we couldn’t figure out how to make this business work,” McLemore explained. “Selling software to aerospace and defense is hard. There aren’t a lot of solutions competing with the big guys for a reason.”

McLemore has seen how the A&D supply chain functions up close while working for both established aerospace behemoths and disruptive machining startups. Her experience includes stints at Airbus and Raytheon, where she helped build anti-ballistic missiles and airplanes. Most recently, she was machining-parts startup Hadrian’s first product manager.

This experience gave her a look into the parts ordering process from the perspective of the customer, at Raytheon, and the supplier, at Hadrian. On both ends, she was confronted with inefficiencies, missed deadlines, and pointless errors.

Even at a startup like Hadrian, with millions in funding from the likes of Andreessen Horowitz and Lux Capital, the same core issues with parts ordering persisted.

“Hadrian’s customers were still sending PDFs and emails to Hadrian,” she said. “Even if Hadrian builds this totally robotic, autonomous factory, all the inputs to the process are still broken.”

“So I called Anne, and I was like, I think I know how we can do this.”

Image Credits: Stell (opens in a new window)

Toward execution

When it comes to parts ordering in A&D, it is not only the technical specifications that need to be communicated to suppliers. Often, parts need to be inspected in certain ways, or tested; those results need to be communicated back to the customer. McLemore said Stell’s platform would also include room for these key deliverables and provide space for communication with customers directly within the software.

That the A&D industry has such outdated workflows may seem surprising, but up until now there has been very little pressure on the biggest companies to change their systems. McLemore pointed to the outsized power of this very small, very powerful group of primes relative to the suppliers.

But the landscape is changing: more venture capital is pouring into aerospace and defense startups, and there’s increasing pressure to secure these critical supply chains by bringing manufacturing back to American machine shops. Suppliers could have more leverage to demand better workflows, which McLemore says benefits both customers and suppliers.

Other things are changing too: legacy primes have historically been disincentivized from changing any process because it introduces uncertainty and risk. But Stell is hoping competitive pressure from outside the traditional industrial base will also nudge them to rethink their systems while not sacrificing mission assurance.

Right now, Stell is “running full speed,” Wen said; she and McLemore are in the process of onboarding Stell’s first dedicated software engineer and are thinking ahead to a design hire. They’re also planning on registering under the International Traffic in Arms Regulations (ITAR), the series of regulations that govern technologies related to U.S. defense.

The company is aiming to get an alpha prototype to 1-2 customers by April. That test period will last until summer; once concluded, McLemore and Wen plan to launch to the industry at-large.

Stell wants to modernize the “unsexy” workflows slowing down America’s industrial base by Aria Alamalhodaei originally published on TechCrunch

DUOS