When Uils launched in 2021, it was a car rental service for rideshare drivers. But after the founders realized that many rideshare drivers don’t have access to credit, particularly in Latin America, the Buenos Aires-based company pivoted to fintech, offering financial services to drivers through a behavioral scoring engine based entirely on a person’s driving history.

Rideshare vehicle lending is a crowded market. Both Uber and Lyft host marketplaces where approved vehicle rental companies can show their wares; Uber has piloted a short-term credit program offering up to $500 to drivers. One of the largest ridesharing companies in China, Didi, started offering loans to drivers in 2019. Meanwhile, lenders like Giggle Finance have long extended credit lines for ridesharing vehicle purchases, maintenance and upkeep.

But Costanzo argues Uils (pronounced “wheels”), which is one of the Battlefield 200 at TechCrunch Disrupt, stands apart in its ability to give a “360-degree” view of drivers in the mobility gig economy. “Being integrated with all the mobility applications available in Latin America, we have a total vision of the driver’s work activities, being able to determine a credit offer that is more adjusted to reality,” he told TechCrunch in an interview.

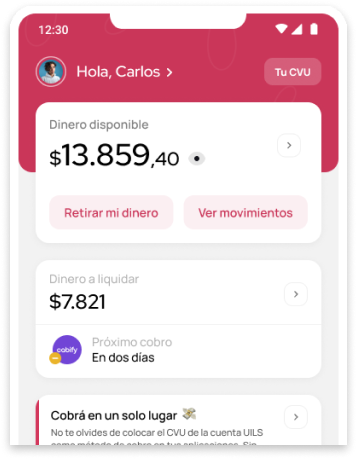

To use Uils, drivers download an app, fill out an application, and connect the app to the ridesharing platforms for which they drive via an API (e.g., Uber). Uils analyzes their history using a machine learning model to determine whether they qualify for a “micro” or consumer loan, considering various factors.

The interest rates range from 0% for the micro loans (for a weekly subscription of $1 to $2) to 145% for the consumer loans. That’s quite a wide range — and sounds sky-high — but Costanzo says it’s reflective of the equally high inflation rate in Argentina, the country where Uils first launched.

“The app has an embedded banking account where drivers collect their earnings from mobility apps,” Costanzo explained. “In that same account, they receive loan funds and pay their installments every week. We have a collection process that runs every 15 seconds so as soon as the mobility app sends the money, we will collect the pending installments before the driver notices … The rent-to-own loans are a leasing, so technically we can get the car back as soon as the driver goes into delinquency, therefore there is a tendency to 0% default.”

It’s a relatively new idea in the lending domain, although services that track driver behavior to offer discounts and benefits have been around for some time. For example, Zendrive collects data about driving habits and awards drivers for making safe decisions. Root Insurance calculates car insurance premiums based on driving patterns, and Avinew rewards customers for using autonomous safety features.

But there are obvious surveillance — and bias — implications. It’s unlikely every driver would be comfortable with the idea of sharing driving histories with Uils, particularly given that the company uses that data to create a risk profile of them. And where algorithms are involved, there’s always the possibility that flaws in the model could lead some drivers to be treated unfairly or poorly. Consider traffic in a driver’s area that forces them to make frequent, sudden stops that under normal circumstances might be considered reckless.

There’s another risk to consider: the challenge of paying back loans in a downtrending economy, especially as interest rates climb and inflation impacts the price of fuel. An April poll from The Rideshare Guy, a ridesharing blog and forum, found that nearly half of rideshare workers quit or starting driving less that month because of spikes in gas prices.

Image Credits: Uils

For its part, Uils says that it requires customers to reauthorize the connections between the app and ridesharing platforms every month, so that tracking doesn’t continue indefinitely. (The company does require customers verify their identity to receive loans, however.) Uils is keeping the details of its algorithm close to the chest, save for revealing 70% of users who’ve applied for loans through the platform have received them. The company also isn’t saying exactly how many of those users have failed to make payments, if any.

“The scoring engine has more than 200 data points for each driver. We have variables like their work schedule, how many trips per day, how many apps do they use, how many cars they have used, among others,” Costanzo said. “After processing the driving history, we will get a score from one to 1,000. Based on our current lending policies, that score will let us know what is the maximum that a driver can receive as a loan.”

After that, Uils has the second layer that’s based on earnings. Depending on how much money the driver makes, they’re able to allocate up to 30% to loan repayment.

But opaqueness aside, Uils’ terms and approach might be less onerous than, for example, those around rentals from Lyft or Uber — which some drivers say make achieving a profit nearly impossible. A 2019 investigative piece found that Lyft paid drivers participating in its Express Drive rental program less per mile than drivers who used cars leased through dealerships. The program imposed restrictions on drivers as well, prohibiting them from making money using their vehicles to work for other services.

Costanzo stresses, again, that these are drivers without access to traditional credit — making their financial situations particularly precarious.

“The biggest competitive advantage is that we apply a matching fund strategy around the installments amount,” Costanzo said. “Drivers will pay the same amount that he pays to rent the car in the informal market, offering a frictionless solution. On top of that, we are the only fintech in Latin America that offers major consumer loans and rent-to-own loans without consulting credit bureaus or asking for a credit card or any other guarantees.”

Image Credits: Uils

Uils is currently raising its second round funding round — totaling $1 million — through a simple agreement for future equity (SAFE), which grants the investors the right to purchase equity in the company at a future date. It values the startup at $7.5 million post-money; founder and CEO Tomás Costanzo says that the new capital will be put toward general “growth and development,” including expanding Uils’ headcount.

“We raised $275,000 in our pre-seed round and used those funds to build and launch our product — a mobile wallet and scoring engine — for 12 months,” he said. “Now, we are expecting this round to help us achieve 24-month additional runway to evolve our scoring engine, develop new features and expand in Latin America — specifically Mexico, Chile and Colombia.”

In the coming months, Uils plans to launch insurance coverage and a buy now, pay later (BNPL) solution — angling to nab a larger slice of the ridesharing fintech market. Regulatory scrutiny could be coming if the BNPL industry’s trajectory in the U.S. is any indication. But for now, Uils is stands to benefit from the relative dearth of direct competition.

“Delivering a solid value proposal and lowering risk through alternative data models will become a requirement to be different in a very competitive market,” Costanzo said. “High-growth models have been replaced with retention ones … The current circumstances will promote efficiency over growth.”

Uils wants to lend LatAm’s rideshare drivers cash based on their driving record by Kyle Wiggers originally published on TechCrunch

DUOS