Hardware hobbyists wanting to get their hands on some juicy single-board Raspberry Pi kit to power low cost electronics projects have been having a frustrating time for more than a year now, as pandemic-triggered global supply chain disruption continues squeezing reseller inventory.

Go try and buy Pi and you can’t miss how official reseller websites everywhere — such as Pimoroni and SB Components in Europe or AdaFruit in the US — are peppered with ‘Out of Stock’ notifications.

Keep looking and you’ll probably stumble across social media stories of enthusiasts forking over multiples on the RRP of sought-after boards via non official reseller routes (like Amazon) — hardware that would usually carry an exceptionally reasonable price-tag.

Unlike Pi itself, these tales of Pi buyer woe are, sadly, all too easy to find online as scalpers have honed in on the supply shortage — firing up stock-buying bots and trying to swoop when a few units appear so they can sell the kit on at vastly inflated prices by exploiting people’s passion to get on with their projects…

One frustrated would-be-Pi buying tipster pinged us directly — wondering: “How is Raspberry Pi surviving in this climate? So many of their products have been (and continue to be) out of stock for years. It’s so bad that numerous products are backordered into late 2023. You also wouldn’t know it from the Buy buttons on their website… it links to vendors which are all out of stock so they are basically burying how bad it is. Anyways, hope they make it through this just be hurting them big time.”

To be fair to the Raspberry Pi Foundation, they have been blogging about the supply issue since last year (when they also had to announce some temporary price increases also linked to the “strange times” in global semiconductor supply) — so claiming they’re ‘burying’ the bad news risks sounding a tad conspiratorial.

The roots of the global semiconductor shortage itself are linked to supply chain disruption triggered by the pandemic impacting labor availability and by COVID-19 lockdowns simultaneously spiking demand for all sorts of consumer electronics (which of course need chips to power them). In short, the proverbial ‘perfect storm’.

Pi’s supply issues are really a neat package of both phenomena, if we can put it that way. (Or: “We have order backlogs from our distributors, and they have order backlogs from their customers,” as Raspberry Pi’s co-founder concisely sums the problem to us.)

The upshot is far from neat for individuals wanting to buy Pi, of course. But the company has stepped into the breach to support its business customers — specifically industrial and commercial OEMs — through these leaner supply times. This means it’s prioritizing available Pi stock for business customers so they can keep serving their customers, hence hobbyists are feeling the (inventory) pinch.

“These are companies (often small ones) who have put their faith in our platform: Livelihoods are at stake, and we feel an obligation to them,” co-founder Eben Upton told TechCrunch, adding: “New production goes to fill these backlogs, which is how we can be consistently building over 100,000 units a week but still see little free stock in channel.”

So while the Pi maker’s core ‘democratizing tech’ educational mission is intrinsically bound up with providing curious individuals with affordable access to programmable computing hardware — so they can play around and learn STEM along the way — there’s no doubt it has had to take the tough choice to ask enthusiasts to join the queue behind Pi-reliant businesses.

“Obviously this translates into reduced availability for enthusiast customers,” he confirmed. “The advice there is buy from Approved Resellers, many of whom operate wait lists, and/or to use tools like rpilocator to keep track of stock as it appears in channel.”

“Go to Approved Resellers,” he reiterated. “We’re not supplying non-approved resellers. Go to an AR, get in the queue. Use rpilocator if you want but go to an AR… that operates a queuing system, get in the queue. We are getting units out. We are still managing to get some units out to that space.”

The message for hobbyists — for now — thus remains a very British one: ‘We’re sorry but you’re going to have to get in the queue and wait your turn.’

But Upton also signalled that the Pi inventory issues should start to ease next year — saying he was hopeful of a resolution “no later than Q2”. “We’re seeing positive signs that the supply chain situation is improving but it will be some months yet before we’re back in the sort of robust stock position we prefer,” he told TechCrunch.

Dealing with demand shock

In a supply chain update back in April, Upton, wrote that a “variety” of supply chain challenges are continuing to disrupt inventory-as-usual.

“The current situation is as much a demand shock as a supply shock,” he explained. “Demand for Raspberry Pi products increased sharply from the start of 2021 onwards, and supply constraints have prevented us from flexing up to meet this demand, with the result that we now have significant order backlogs for almost all products. In turn, our many resellers have their own backlogs, which they fulfil when they receive stock from us.”

He also reiterated the aforementioned, official Pi advice for individuals trying to get hold of kit — advice that continues to apply: Namely, buy Pi from an approved reseller (i.e. to avoid being scalped); and try to find a reseller that takes pre-orders and can (hopefully) give you an idea of how long you’re doing to be waiting… And, well, the (obvious) follow-on is: Prepare to be patient while you wait to get your Pi.

Pimoroni co-founder, Jon Williamson, only had words of praise for Raspberry Pi (aka, the Pi-manufacturing arm of the charitable Pi Foundation) for having done “really well” keeping “SBC” (single-board computing) kit in-stock “until a long way into the shortages, especially given their popularity”, as he put it to us in an email.

He also pointed us back to Pi’s April blog post — calling it a “pretty thorough” update which provides “the best info” on the supply crunch.

“We get small drops of SBC stock at infrequent intervals, much like the other resellers,” Williamson said of Pimoroni’s own Pi supply situation, saying the strategy it’s using to weather inventory challenges attached to its core product is to focus on other Pi products that are in more plentiful supply. “We’ve got a good flow of RP2040/Pico stock and are focusing on our products that support that,” he noted.

Upton’s April update also urges buyers to consider the (2020 launched) Raspberry Pi 400; or the (2021) Pico — which is made using Pi’s own silicon and an in-house developed chip (RP2040) — as alternatives to other more supply-constrained boards, as he said those lines have been less affected by supply issues so you should have less of wait to get your Pi.

Given the ongoing chatter around shortages, we reached out to Upton for a chat about how it’s been managing such a sustained period of inventory constraints — a phone call, it should be said, that Upton offered despite being on holiday at the time (so he certainly can’t be accused of running from the issue).

He also readily agreed it’s a frustrating situation for Pi buyers — and indeed for everyone at Raspberry Pi which has always had a dual focus on homebrew (hobbyist) and industrial (business) users so individual buyers are absolutely a core component (pardon the pun) of its customer base.

“We’re really sorry — this isn’t a situation we’ve chosen,” he volunteered during a chat which took place to an evocative backdrop of medieval church bells and piazza buzz. “This isn’t a situation anyone wants to be in. And we’re working our knuckles to the bone trying to get out of it.”

He also had some good news: Telling us he’s hopeful that the sustained inventory squeeze will start to ease from early(ish) next year. So — fingerscrossed — those annoying ‘Out of Stock’ notifications should start to get less visible in 2023. (The usual ‘black swan event’ caveats do of course apply, especially as 2022 has had no shortage of fresh geopolitical shocks, such as Russia starting a land war in Europe.)

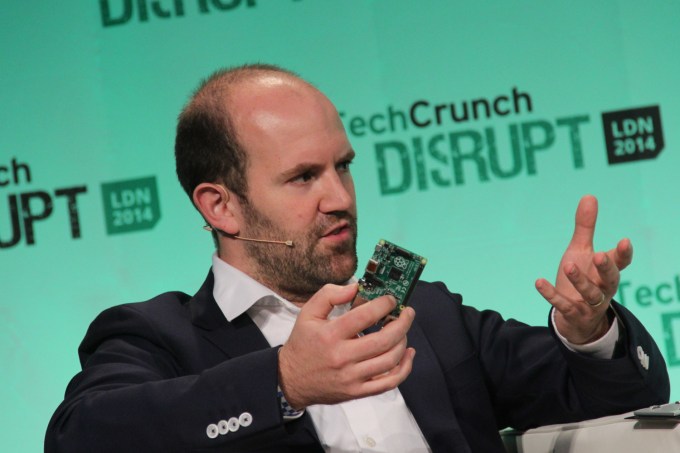

Eben Upton with a slice of Pi back at TC Disrupt London in 2014 (Image credits: TechCrunch)

“The good news is we are hopeful that, independently of whether the macro environment changes, our specific supply challenges are going to get a lot better in, say — no later than — Q2 of next year,” he said. “I think that would be a good guess because there are some supply side factors that are going to help. There’s a lot more manufacturing capacity.”

His confidence on this relates to having greater production capacity for manufacturing on 28 nm silicon — which is used in Pi 4 products.

“There’s a lot more production capacity for that… coming online in the next 12 months — and I think that will probably be the thing that brings our specific shortages to an end,” he predicted. “I’m probably pretty comfortable with Q2 [as a projected end-date for Pi’s supply crunch] so the challenge for us now is how do we bring that into Q1 — how do we eke a couple of months out… how do we just squeeze it a little, what levers can we pull to get that sort of ‘return to growth’?

“Because this isn’t about contraction — it’s about a lack of growth. It’s how do we get to a return to growth a couple of months earlier than we get it naturally from the system.”

Asked what’s been the biggest supply chain problem affecting Pi production to-date — or whether there have been a number of different issues since the pandemic disruption kicked off — Upton said it’s really been a shifting patchwork of supply constraints that they’re having to manage and respond to as each one occurs.

“It’s pretty broad-based, actually. On any given day there’s certain components that’s challenging but it’s been pretty broad-based. It’s one of those things where you can kind of feel there’s a natural production rate that’s hard to push beyond because you have some constraint on, you know, core logic and then you get through that and wireless is a problem or some power component is a problem,” he explained.

“We’re pretty good in that most components on the board are at least dual-source. And that’s given us a bit of resilience. But really it’s very persistent, very broad-based,” he added. “It’s everything.”

He recounted one supply issue with a board that was triggered by a new lockdown being ordered in Shanghai — describing these “little tactical shortages which take the line down for a day or two” as still being capable of hitting production rates as they ripple through (and knock down) the supply chain.

“We had a problem that we were recovering from a silicon front-end issue with a supplier — a wafer supplier — but then their packaging and test and ship-out was in Shanghai and no one could go to work in Shanghai,” he said, adding that these sorts of “geographical” issues are certainly an ongoing headache. “Probably rolling lockdowns in China are — I wouldn’t say the biggest source of strategic shortage — but they’re the biggest source of day-to-day [supply issues].”

Unlike governments in the West, the Chinese state has continued to pursue a ‘zero COVID-19’ policy — which has meant large scale lockdowns are still occurring there from time to time (when COVID-19 case clusters are identified), such as a Shanghai city-wide lockdown in March.

Such events have the potential to set off localized labor constraints which can throttle international hardware production if companies are relying on China-based sourcing (which is of course hard to avoid if, like Pi, your business is building electronics).

Though, in Pi’s case, Upton told us it has generally been able to rely on sourcing components elsewhere to get around localized disruptions. “Fortunately most of those components are multi-source components — and you tend to be able to work around those sorts of things,” he said in relation to the Shanghai incident.

He added that the Pi maker has done a lot more multi-sourcing since the global supply chain disruption kicked off. “We were pretty robust already — because I mean you just have to be, even in normal times — you can’t put all of your eggs in one basket. But we’ve done a lot more.”

Of course workarounds, by their nature, are unlikely to be entirely impact free when it comes to maintaining ‘normal’ production rates — especially in the middle of a global supply crisis. There’s always going to be some delay/contingency switching cost vs when your primary suppliers are all running smoothly. So it’s about patching the supply chain to sustain production as best you can, rather than being in a position to ramp rates up.

Plus there’s another, harder to quantify impact attached to the global semiconductor shortage, per Upton: A cost to engineering time. And therefore — to some degree — to product innovation. Simply put, supply chain disruption doesn’t just slow down production; it applies the brakes to your ability to develop the next big thing. Which means there could be a longer wait for the next Pi too.

“One real annoyance, I guess, for us it that we’re spending engineering effort on qualifying component alternatives when we’d rather be spending engineering effort on making the next big thing,” he said, adding: “I think that’s pretty common across the industry. It’s sinking engineering time in a way which is really unhelpful from an innovation perspective.

“We’re probably spending 40% of our engineering capacity on things which I would not traditionally consider to be desirable — in that they don’t move the ball. They keep the ball where it is; they don’t move the ball forward… I think that that is a challenge.”

Keeping industrial customers fed

The global semiconductor shortage lies at the root of the Pi supply problem since it’s prevented the company from scaling manufacturing to meet rising demand, as would normally be the case when a business finds itself in the (otherwise) happy situation of increased appetite for its products — exactly because electronics supply issues are so pervasive.

Basically: There’s no perfect workaround for these global shortages — meaning Pi simply can’t serve all the demand for its products right now.

The company assembles almost all its products in UK-based factories in South Wales but, per Upton, it also relies on a surge facility for times of peak demand, such as around product launches — using a Sony a ‘pick and place’ facility in Japan to take care of a portion of the front-end assembly work before returning the panels to Wales where Pi’s own factories take care of the rest (also doing the testing, packing and shipping). Pico products are also made in Japan. And those boards are in less of a supply-constrained position than most other kit.

But, for now, inventory disruption remains the rule as demand for Pi’s products continues to outstrip the production rate it can deliver. (In its April update, Upton wrote that it had “consistently” been able to build “around half a million” boards and modules each month for the past six, despite its various supply challenges — so at a reported 100k+ units per week now Pi’s production rates appear to be roughly around, or maybe slightly below, that level.)

As we’ve reported before, demand for Pi products accelerated during the pandemic when lots of people were stuck indoors twiddling their thumbs for things to do — some with extra disposable income burning a hole in their pockets. So lockdown boredom seems to have encouraged a bunch of people to take the plunge and give hardware hacking a whirl.

Upton also points to the concern over kids’ education at a time when schools were shut being another big demand driver since Pi microprocessors can be turned into highly affordable computers for home study — just salvage a few old monitors and keyboards, say by tapping up a local businesses for donations, and off you go with cheap computers for kids. (Pro tip: He recommends asking law firms to chip in unused peripherals as he suggests they tend to hang onto their old IT kit.)

Interestingly, though, he said the rise in demand for Pi has been sustained even as most pandemic lockdowns have eased. So it has not experienced the sort of spike-to-crash that hit pandemic-accelerated videoconferencing platforms when in-person meetings started back up again.

“Demand is just wild at the moment,” he told us. “Everything is [up]. Demand in the industry is very, very strong. Ok, maybe there’ll be a downturn… but the shoe is taking a lot longer to drop than we might have expected.”

It’s not entirely clear what all the growth drivers are exactly but one element stoking demand for Pi’s products is the industrial side of its business — as Upton said the most recent refresh to its embedded computing line (aka Compute Module) has been in especially high demand ever since it launched (just prior to the pandemic).

“Probably the biggest single thing was we launched Compute Module 4 — at the tail end of 2019. And it had a really hard take-off. It’s still inexplicable to me really… It just took off like a rocket. And to this day I don’t really know why.

“It might be the reduced availability of other stuff. If you think about what competes with Compute Module — [it’s] doing a forecast and design yourself. So putting a chip down, going and buying chips, going and buying memory, designing a board, and putting it yourself down on the board. And what it could be with Compute Module is the unavailability of older silicon — so sort of the global shock — has coupled through into us because people have gone well I can’t go and buy an NXP chip… so I’ll use that Compute Module; I know those guys, we trust them.”

“It was just this very strange curve where Compute Module 4’s been blowing the roof off,” he added. “The business for us blew through to over 1M units a year, very, very quickly.”

High demand for the Compute Module has a direct knock-on impact on Pi’s ability to supply SBC inventory since he said both lines use the same components — describing the issue as “kind of a finite [resource]”. “The sum of Modules plus single-board computers is kind of the thing that is constrained, to a certain extent,” he added. “When modules go up single-board computers come down.”

The supply squeeze has meant a big change to how Pi interacts with its industrial and OEM customers — requiring it to establish a much closer working relationship than it had pre-pandemic when it was able to pump out ample extra stock.

Since the April blog post, Upton said Pi has taken on more than 2,000 direct OEM supply relationships.

“We do think we’re doing a great job with the OEMs,” he told us. “The value proposition for Raspberry Pi has always been that you can buy 100,000 of them tomorrow — and that’s incredible in our industry, right. Nobody does that… And so when you have that kind of world you don’t really need to relate to your OEMs very much; you know, the product’s available — you just go and buy it when you need it. [But] in this [supply] constrained environment what that’s caused us to do is have much closer relationships with our OEMs.”

Upton urged any OEMs that are still struggling to get the products they need to get in touch via a dedicated business@raspberrypi.com email — in order that it can try to support them.

“If people are having trouble they can mail business@raspberrypi.com and we’ll find out who they are,” he said. “We’ll do our very best to find out they’re not scalpers — that they’re real OEMs with real demand. We don’t want people who are going to resell them. We don’t want people who are building inventory, you know, building kind of a buffer so that they feel comfortable. We want to know what people’s exact requirements are — how many do you need on every given day to keep the line running so that we are not the one problem for your production.

“We find out what those are and then we do our best to fulfil them. And we’re making hundreds and hundreds of Raspberry Pis a month — and I think that’s enough to feed, if well managed, and if you get rid of the panic buying [tendency] that’s enough; that will feed the OEM customers. So we think we’re doing a good job keeping our OEMs up but the heartbreaking thing for us of course is we’re an enthusiast business — we’re equal parts an industrial business and an enthusiast’s, hobbyist’s business.”

“Those are both really important to us,” he added. “So when we talk about ‘getting back to growth’ that’s what we’re talking about — getting back to that kind of ‘stocked’, ‘100,000-200,000 inventory sloshing around in the channel’ kind of place where we were for a decade, for the eight or nine years before this kicked off.”

Upton reiterates the aforementioned advice for Pi hungry individuals, too — pointing makers back to products that are less supply constrained, such as the Pico.

“In January last year we rocked up with our own first party silicon. We control all the main silicon in the Pico products — because the RP2040 microcontroller we made ourselves. And, you know, what a time for that to appear! So Pico is one [product that’s less supply constrained]. And we’ve got some budget — we can built 10M-20M Picos if we need to. There’s no problem with that,” he said, adding the Pico line is selling “a few million” units a year currently.

“Obviously it’s not the Raspberry Pi platform — when people think Raspberry Pi they tend to mean the big model, what we call ‘big Raspberry Pi’ — the Linux Raspberry Pi. But actually what you can do with the new wireless one, the Pico W, there’s quite an overlap.”

He also observed that some hobbyists have been able to switch to alternative kit than they had planned on using — pointing out that the Pico can work as a stand-in for the Zero.

“It’s interesting how many people’s applications for Raspberry Pi actually consist of running a Python script and reporting the results and communicating the data over wi-fi and that’s it. So it’s interesting to watch people find ways to do what would have been Raspberry Pi Zero projects — or Raspberry Pi Zero W projects — and find ways to do those projects using the Pico and Pico W platforms because they’re in better supply… Because of course the Pico W has got wireless capability, it runs Python.”

“The number of high level programming languages on microcontrollers changes the game,” he added, giving a nod to Arduino for its work in making the space more accessible. “Microcontrollers always had… a bit of a sort of hairy-scary reputation. But you can just write a Python script — it’s just like a regular piece of coding.”

Also on the sunnier side, Upton brushes off any concerns linked to the UK’s current economic turmoils — where interests rates and inflation are soaring and the British pound is, er, not — saying he’s confident economic issues on home soil won’t cause Pi fresh supply (and/or cost) headaches in the near term.

This is because the UK company is established as a dollar business, giving it some padding against local fiscal turmoil.

“We’re a dollar business. We buy things in dollars, we sell things in dollars, we report all our financials in dollars. So we’re a dollar business based in Cambridge, UK. The only thing that’s directly [in sterling] is our salary expense, or most of our salary expense because we do have some US employees,” he explained.

“In the medium term, of course, our manufacturing salary expense is in sterling and therefore you would expect — it’s a slow effect — the change in the manufacturing price quotes based on salary costs but over time you would expect dollar denominated manufacturing costs to change… But, by and large, and certainly the direction in which exchange rates are moving at the moment isn’t a problem for us in that it’s making… sterling fixed costs cheaper at the moment.”

“But it’s not a big effect — at all — on us. And to the extent it is an effect it’s on the ‘positive’ [side],” he added. “I mean, you can’t devalue the oasis of debt and no one’s advocating for sterling’s devaluation to make British manufacturing look better but to the extent there is an effect it’s impossible to denominate.”

Waiting for Raspberry Pi: Eben Upton talks supply constraints and demand shock by Natasha Lomas originally published on TechCrunch

DUOS

(@glennzw)

(@glennzw)

(@CharlesCalzia)

(@CharlesCalzia)