About 150 multinational financial technology companies and 400 delegates from various financial technology companies converged in Ghana, Accra on Tuesday, September 27 for the West Africa Money and Decentralised Finance (DeFi) summit.

The summit was to connect industry leaders from the African fintech and crypto industries with international players.

The summit is a two-day event that was hosted at the Movenpick Hotel in Accra and is the West African edition of the Africa Tech Summit.

The event was also to create a network between financial technology companies across the globe, and companies in decentralized finance (DeFi), payments, crypto, Web3, digital lending, FX, digital identity, cybersecurity, insurtech, mobile money, investors, start-ups, regulators and industry stakeholders.

Among other things, the summit was meant to discuss the future of cryptocurrency and decentralised finance in Africa.

Africa Money and DEFI Summit Director, Lauren Adair explained why Ghana was chosen to host the summit in West Africa.

“We thought this would be the best place to have the Africa Money and DEFI summit because the ecosystem is here and Ghana was the place of choice. Looking at this being a new way to bring together the ecosystem here in Ghana,” she said.

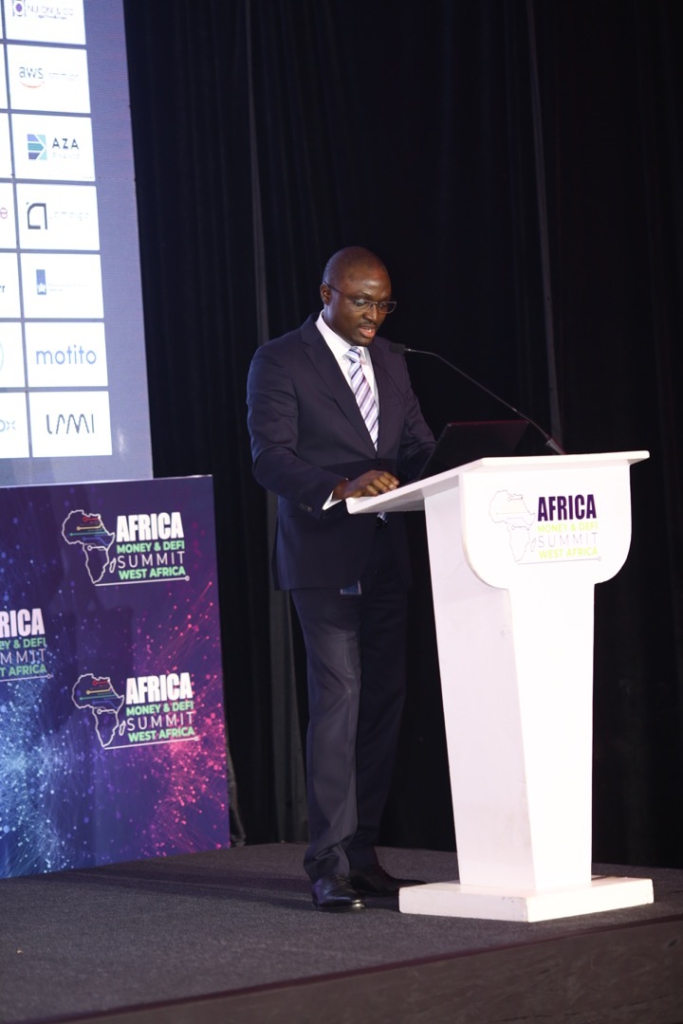

Delivering the keynote address on behalf of the 1st Deputy Governor of the Central Bank, Head of Fintech at Bank of Ghana, Kwame Oppong said “so far a total of 47 payment service providers and mobile money operators have been given approval both Ghanaian and foreign across various license countries to provide payment services.”

He explained that although the volatility of crypto and Fintech will be hard on the Central Bank, the BoG is monitoring developments in the Fintech space to implement measures that will avoid any obstruction in the ecosystem.

Mr. Oppong stressed that the Central Bank will continue to collaborate with Fintech industry players to ensure safe and sustainable regulations.

“It is worthy of attention as the volatility is hard on bank holders. To this end, the Bank of Ghana will continue to monitor developments and implement measures fit for virtual assets to forestall any risk to the ecosystem in collaborating with other regulators and stakeholders where necessary.

“Any regulations with issues will be in line with our quest to promote safe, sustainable and inclusive innovation that can build confidence in the ecosystem,” he stated.

The summit was graced with a panel discussion on Digital Payment race by industry players in Fintech.

Leader of Product Expansion in Ghana for Paystack, a Pan-African online payment company, Kwadwo Owusu-Agyeman implored the regulators in the industry to partner more with Fintech companies to ensure enough cybersecurity and prevention of fraud issues.

Some key speakers for the summit included; Country Manager for Visa, Adoma Owusu, Country Manager for Cellulant, Eric Kortey, General Manager of Commercial at Zeepay, Dede Quarshie, Founder and C.E.O of WiPay, Aldwyn Wayne, CEO of Deimos, a cloud native developer at a security operations company, Andrew Mori and a host of other speakers.

Other sessions of the summit included masterclass sessions for the participants on various topics such as innovating and scaling fintech on AWS and deploying and testing smart contracts on Polygon.

Startup Fintech companies were also given opportunities to pitch their business ideas to potential investors present at the summit.