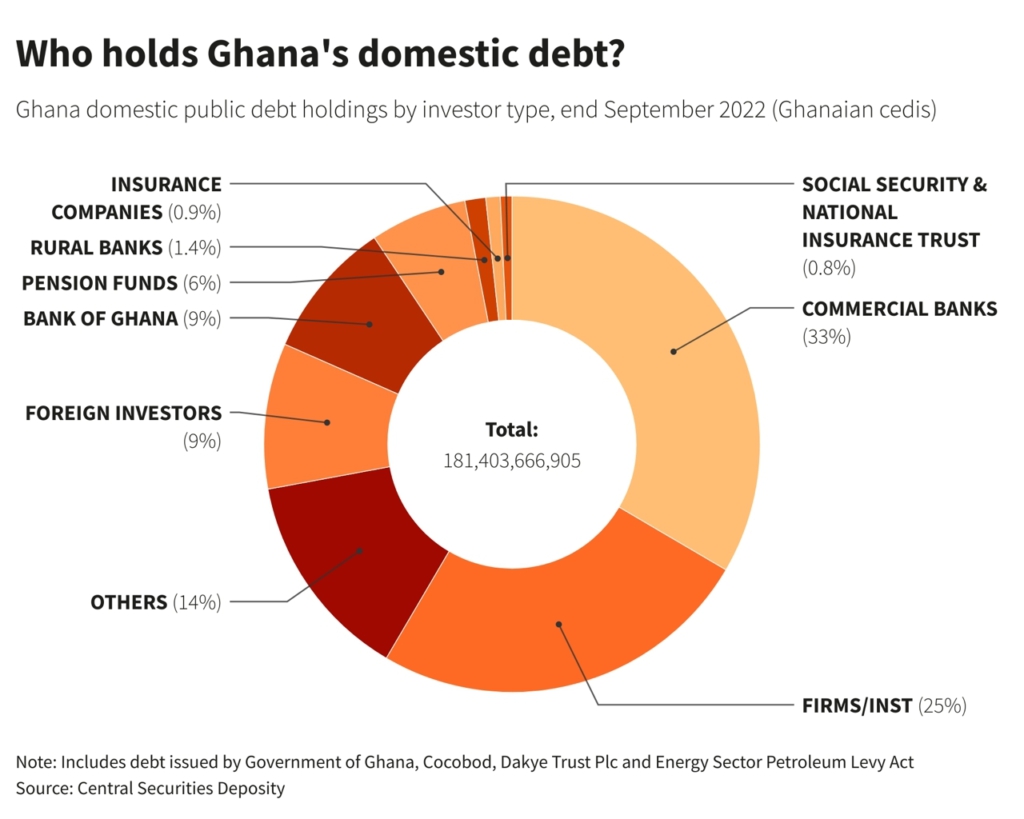

As of September 2022, Ghana’s total domestic public debt was 181,403,666,905 Ghana Cedis.

With this high level of debt, it’s important for the government to closely monitor the debt and make sure that it is sustainable in the long term.

Ghana’s domestic public debt is held by a diverse group of investors. According to data from the country’s Ministry of Finance, commercial banks hold the largest portion of Ghana’s debt, at 33 percent.

This is followed by firms and institutions, which hold 25 percent of the country’s debt.

Other investors, including individual bondholders, hold 14 percent of Ghana’s domestic debt. This group includes retail investors who have purchased government bonds as a way to save or invest their money.

Foreign investors also hold a significant portion of Ghana’s debt, at 9 percent. This includes investors from other countries who have purchased Ghanaian government bonds as a way to diversify their portfolios and invest in emerging markets.

The Bank of Ghana, the country’s central bank, holds 9 percent of Ghana’s debt. This is not uncommon, as central banks often hold government debt as a way to manage monetary policy and stabilize the economy.

Pension funds hold 6 percent of Ghana’s domestic debt, while rural banks hold 1.4 percent, companies hold 0.9 percent, and SSNIT (Social Security and National Insurance Trust) holds 0.8 percent.

It’s also worth noting that this information is based on a specific date and it’s always best to check with the Ministry of Finance for most recent figures.