Thanks to a months-long shakeout, the crypto market experienced one of the most drastic drawdowns in its history in 2022. But questions are arising about when (if?) major cryptocurrencies will recover.

The global crypto market capitalization, which makes up the total value of all crypto assets (including stablecoins and tokens), has fallen roughly 64% from $2.2 trillion to about $797 billion year to date, according to CoinMarketCap data. The two largest cryptocurrencies by market cap, bitcoin and ether, have fallen 64% and 67%, respectively, during the same time frame.

With a loss of more than half their value, one could argue that these cryptocurrencies can’t recover. But when you zoom out and look at the overall picture, things aren’t that bad for bitcoin and ether, despite what transpired this year.

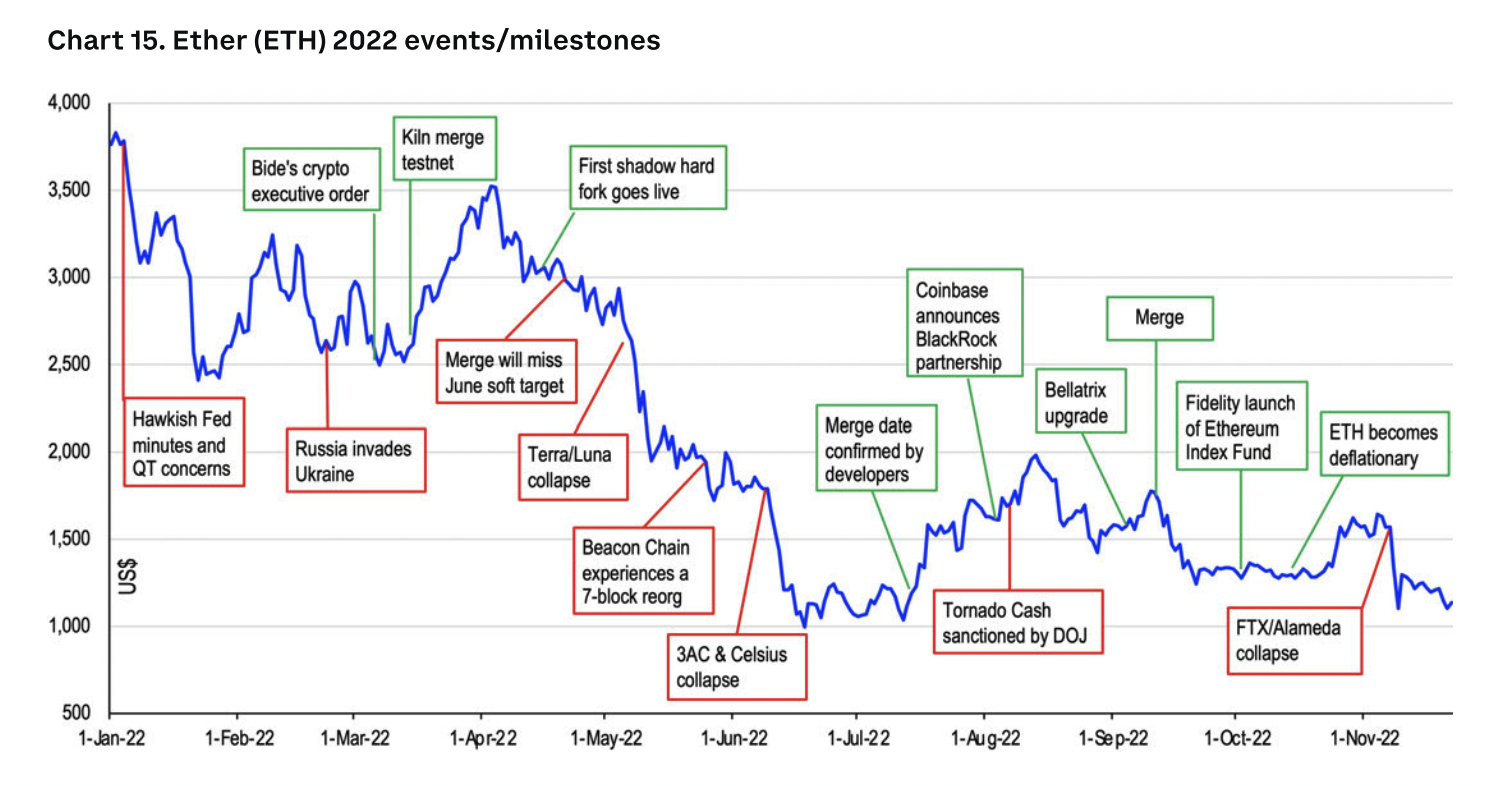

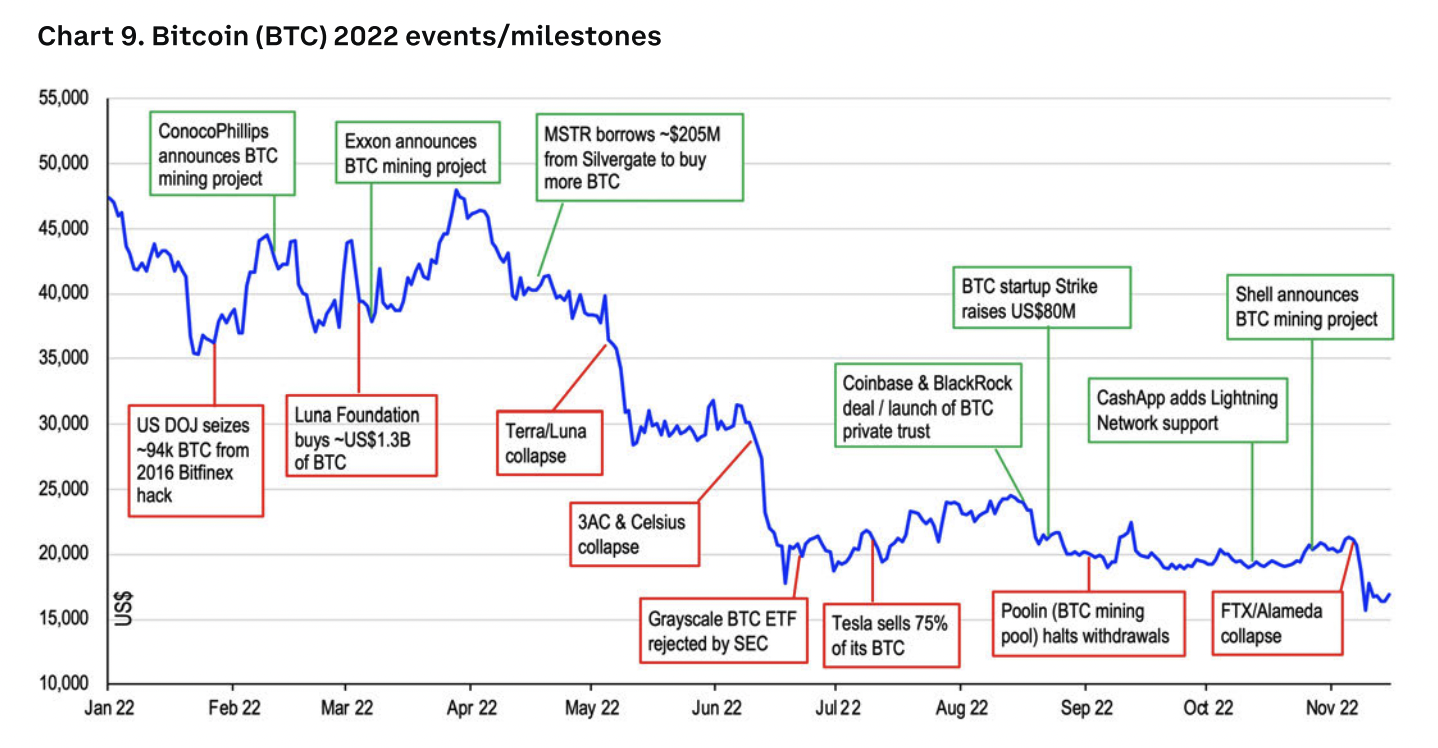

Let’s look at how significant crypto and global events from this year affected the two biggest cryptocurrencies.

Image Credits: Coinbase (opens in a new window)

When the Terra/LUNA ecosystem collapsed in early May, within about six weeks, over a billion dollars of the total crypto market cap was wiped out, dropping from about $1.8 trillion to about $820 billion, data shows. Comparing against the largest cryptocurrencies again, bitcoin and ether both fell over 50% in that period.

Just focusing on that event, the decline looks (and, fair enough, was) brutal.

Yet, since that big drop, both bitcoin and ether have held in the same range, even after FTX, one of the largest crypto exchanges, collapsed last month and filed for Chapter 11 bankruptcy.

Will Bitcoin and Ethereum prices stagnate, sink or rebound in 2023? by Jacquelyn Melinek originally published on TechCrunch

DUOS